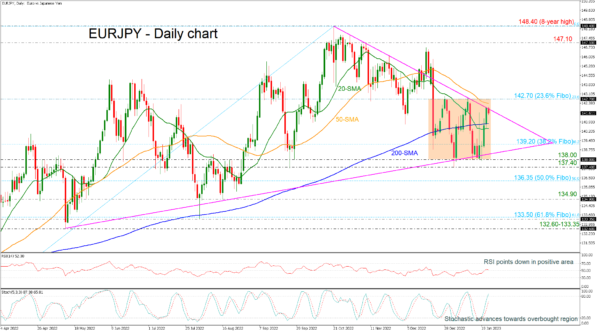

EURJPY has been developing within a symmetrical triangle in the long-term timeframe, taken from the troughs in May 2022 and the peak in October 2022. Moreover, in the short-term view, the price is consolidating within a trading range with upper boundary the 23.6% Fibonacci retracement level of the up leg from 124.40 to 148.40 at 142.70 and lower boundary the 138.00 psychological mark, while it found strong resistance at the downtrend line at the moment.

Technically, the RSI indicator is sloping slightly down in the positive territory, while the stochastic is approaching the overbought area, suggesting more gains in the near term.

If the bulls manage to climb beyond the downtrend line and the 50-day simple moving average (SMA) at 142.35 may hit the 23.6% Fibonacci at 142.70. A successful rally above them could change the recent neutral mode to bullish, testing the 147.10 resistance and the eight-year peak of 148.40.

On the other hand, a continuation of the recent retreat could open the door for a touch of the 200-day SMA at 140.80 and the 20-day SMA at 140.45. Below these lines, the 38.2% Fibonacci at 139.20 and the 138.00 round number may halt bearish actions. However, if the bears break that level too, this could take the market towards 137.40 and 136.35, which is the 50.0% Fibonacci, shifting the bias to bearish again.

All in all, EURJPY is looking neutral in the short-term timeframe and traders need to wait for a jump above 142.70 or a drop below 138.00.