Key Highlights

- EUR/USD started a downside correction from the 1.1040 zone.

- It traded below a key bullish trend line at 1.0880 on the 4-hours chart.

- Gold price declined heavily below the $1,920 support zone.

- Crude oil price is moving lower towards the $72 support zone.

EUR/USD Technical Analysis

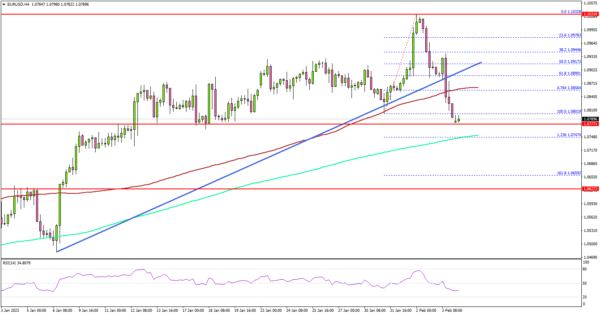

The Euro attempted a decent increase above the 1.1000 resistance against the US Dollar. However, EUR/USD struggled to clear 1.1040 and started a downside correction.

Looking at the 4-hours chart, the pair declined below the 1.1000 and 1.0950 support levels. There was break below a key bullish trend line at 1.0880. The pair even declined below the 61.8% Fib retracement level of the upward move from the 1.0801 swing low to 1.1032 high.

The pair settled below the 1.0850 level and the 100 simple moving average (red, 4-hours). It is now trading near the 1.0780 support zone.

The next major support is near the 1.0750 level and the 200 simple moving average (green, 4-hours). If there is a downside break, the pair could decline towards the 1.0680 level.

On the upside, the pair is facing resistance near 1.0850 and the 100 simple moving average (red, 4-hours). The first major resistance is near the 1.0880 level. A clear move above the 1.0880 resistance might start a steady increase towards the 1.0950 resistance zone.

Any more gains could open the doors for a move towards the 1.1000 level. The next key hurdle is near 1.1040, above which the pair could climb towards the 1.1200 resistance zone.

Looking at gold price, there was a strong bearish reaction after the bears pushed the price below the $1,900 support zone.

Economic Releases

- Euro Zone Retail Sales for Jan 2023 (YoY) – Forecast -2.7%, versus -2.8% previous.

- Euro Zone Retail Sales for Jan 2023 (MoM) – Forecast -2.5%, versus +0.8% previous.