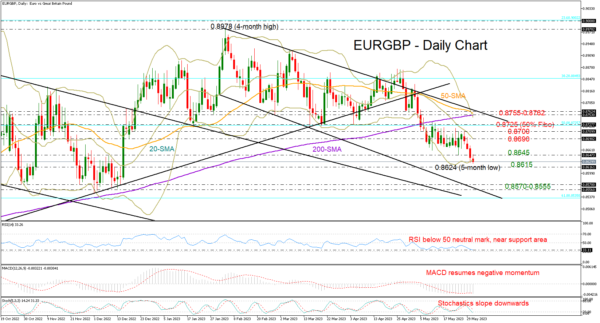

EURGBP resumed its bearish direction after a short period of trading sideways, falling to a new five-month low of 0.8624 on Wednesday.

Market sentiment weakened following the rejection near the 20-day simple moving average (SMA) and there might be more selling activity in the short term given the negative trajectory in the momentum indicators. Still, with the price trading near the lower Bollinger band at 0.8630 and the RSI testing its 2022-2023 lows, a pause in the ongoing bearish action or an upside correction could be possible.

The former constraining zone of 0.8615, which acted both as support and resistance in the second half of 2022, could be the last chance for pivoting higher before the price potentially revisits the lower boundary of the bearish channel and its 2022 lows within the 0.8570-0.8555 zone.

In the event of an upside reversal above 0.8645, the bulls may push towards the 20-day SMA at 0.8690. If they crawl above the 0.8700-0.8725 border too, the door will open for the 200-day SMA and the channel’s upper band at 0.8762.

Note that the 50-day SMA is looking to cross below the 200-day SMA for the first time since January 2021, signaling a continuation of the current negative trend in the price.

In a nutshell, the bearish wave in EURGBP could gain new legs in the short term. Some congestion could emerge around 0.8615 before selling forces resurface.