Key Highlights

- Crude oil prices surged above the $76.50 and $77.00 resistance levels.

- A major bullish trend line is forming with support at $77.00 on the 4-hour chart.

- Gold prices could gain bullish momentum above $2,040.

- EUR/USD is at risk of more downsides below the 1.0800 level.

Crude Oil Price Technical Analysis

In the past few days, Crude oil prices saw a strong increase above the $75.00 level. The price climbed above $76.20 to move into a positive zone.

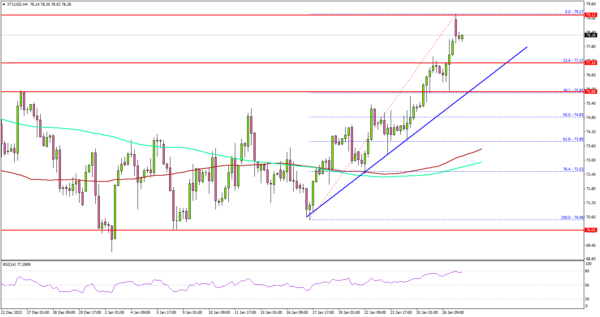

Looking at the 4-hour chart of XTI/USD, the price settled above the $76.50 zone, the 200 simple moving average (green, 4-hour), and the 100 simple moving average (red, 4-hour).

Finally, the price climbed above the $78.00 level and tested the $79.20 zone. A new multi-week high was formed at $79.17 and the price started a consolidation phase. The first major support on the downside is near the $77.20 level.

There is also a major bullish trend line forming with support at $77.00 on the same chart. The trend line is close to the 23.6% Fib retracement level of the upward move from the $70.48 swing low to the $79.17 high.

The next major support is at $75.85, below which the price might test the 50% Fib retracement level of the upward move from the $70.48 swing low to the $79.17 high at $74.80. Any more losses might send oil prices toward the 100 simple moving average (red, 4-hour) at $73.50.

On the upside, the price is facing hurdles near the $79.20 level. The next major resistance is near the $80.00 zone, above which the price may perhaps accelerate higher. In the stated case, it could even visit the $82.50 resistance.

Looking at gold prices, the bulls are aiming for a recovery wave above the $2,040 and $2,050 resistance levels.

Economic Releases to Watch Today

- Euro Zone Gross Domestic Product for Q4 2023 (Prelim) (QoQ) – Forecast -0.1%, versus -0.1% previous.