Key Highlights

- EUR/USD started a recovery wave from the 1.0600 zone.

- A key bullish trend line is forming with support at 1.0680 on the 4-hour chart.

- GBP/USD is eyeing an upside break above the 1.2550 resistance zone.

- Gold prices are consolidating near the $2,320 zone.

EUR/USD Technical Analysis

The Euro extended its decline below the 1.0650 level against the US Dollar. EUR/USD tested the 1.0600 zone before the bulls appeared.

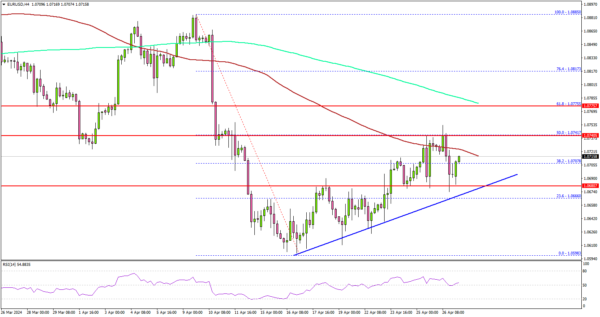

Looking at the 4-hour chart, the pair traded as low as 1.0598 and recently started a recovery wave. There was a move above the 1.0650 and 1.0680 resistance levels. The pair even tested the 50% Fib retracement level of the downward move from the 1.0885 swing high to the 1.0598 low.

However, the bears seem to be active near the 1.0740 level. EUR/USD is now consolidating near the 100 simple moving average (red, 4-hour).

Immediate resistance is near the 1.0740 level. The first key resistance is near the 1.0775 zone and the 200 simple moving average (green, 4-hour). It is close to the 61.8% Fib retracement level of the downward move from the 1.0885 swing high to the 1.0598 low.

A clear move above the 1.0775 resistance could send the pair further higher. In the stated case, EUR/USD bulls could even aim for a move toward 1.0850.

Immediate support is near the 1.0680 level. There is also a key bullish trend line forming with support at 1.0680 on the same chart. The next major support is at 1.0620. If there is a downside break below the 1.0620 support, the pair might test 1.0600. The main support is now forming at 1.0580. Any more losses might send the pair toward 1.0520.

Looking at Gold, the price extended losses and it seems like the bears are active near the $2,350 resistance zone.

Economic Releases

- Euro Zone Economic Sentiment Indicator for April 2024 – Forecast 98.1, versus 96.3 previous.

- German Consumer Price Index for April 2024 (YoY) (Prelim) – Forecast +2.2%, versus +2.2% previous.