As China began trading Oil in Chinese Yuan contracts, there was an air of risk-off to start the week, as the Dax almost made a double bottom with the 6th of February lows shortly after NYSE opened yesterday. Stocks globally rallied during the latter part of the US session yesterday, and during the Asian session earlier today. German import prices were negative for this month, which is good for input costs/prices for exporting companies on the Dax, and is largely expected with the EUR strengthening generally. On the flipside, the strengthening EUR could be seen as a rise in export prices and weakening demand and income for Dax companies.

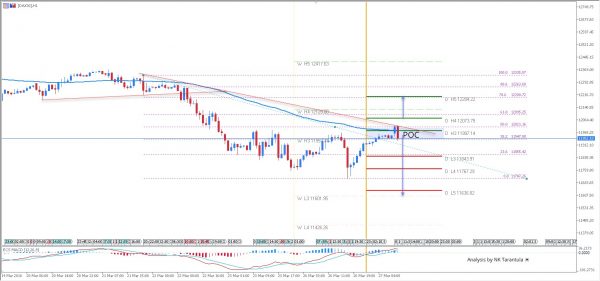

The DAX30 is within the POC zone and it could reject from 11947-12020. Descending trend line is still keeping the bearish trend intact. Targets are 11843, 11767 and 11600. Have in mind that if the price gets to 11600-636 it could reject to the upside. However a spike above 12075 negates this bearish scenario and next target could possibly be 12205.

W H3 – Weekly Camarilla Pivot (Weekly Interim Resistance)

W H4 – Weekly Camarilla Pivot (Strong Weekly Resistance)

D H4 – Daily Camarilla Pivot (Very Strong Daily Resistance)

D L3 – Daily Camarilla Pivot (Daily Support)

D L4 – Daily H4 Camarilla (Very Strong Daily Support)

POC – Point Of Confluence (The zone where we expect price to react aka entry zone)