US commercial crude oil inventories dropped -2.5m barrels in the week ending March 18, larger than expectation of -0.7m decline. At 413.4m barrels, oil inventories are about -13% below the five year average for this time of year.

gasoline inventories dropped -2.9m barrels. Distillate dropped -2.1m barrels. Propane/propylene rose 0.3m barrels. Total commercial petroleum inventories dropped -6.7m barrels.

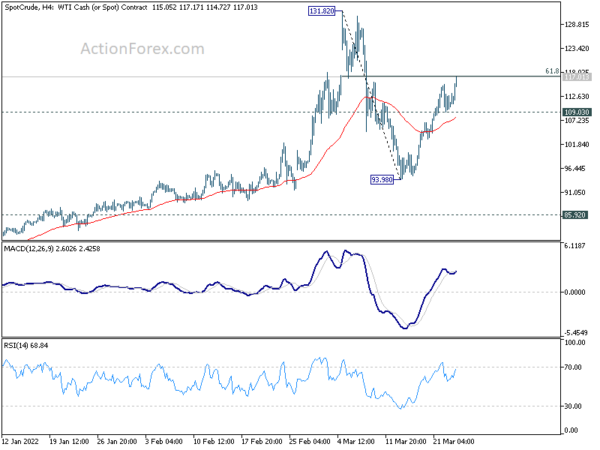

WTI crude oil’s rebound from 93.98 resumes today and it’s now pressing 61.8% retracement of 131.82 to 93.98 at 117.36. Sustained break there could pave the way back to 131.82 high. And in any case, further rally will now remain in favor as long as 109.30 minor support holds.

While the correction from 131.82 was deep, WTI held well above 85.92 resistance turned support. It also drew notable support from 55 day EMA, keeping medium term outlook bullish. Thus, while the corrective pattern from 131.82 might still extend with another falling leg, an eventual upside breakout is still favored.