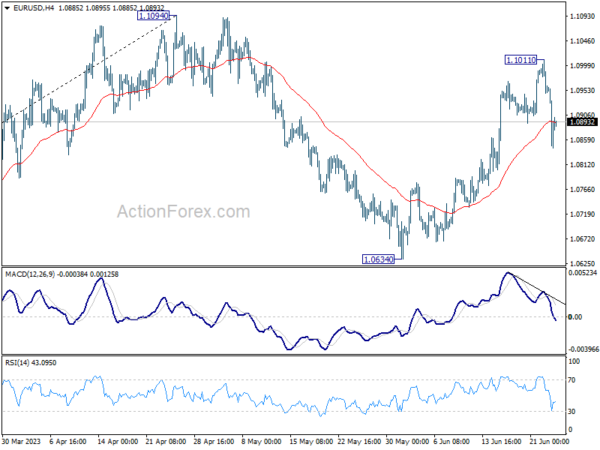

EUR/USD’s late decline last week suggests that a short term top was formed at 1.1011 on bearish divergence condition in 4H MACD. Decline from there is tentatively viewed as the third leg of the corrective pattern from 1.1094. Initial bias is now on the downside this week. Sustained break of 55 D EMA (now at 1.0838) will target 1.0634 support and below. Nevertheless, rebound from current level, followed by break of 1.1011 will target a test on 1.1094 high instead.

In the bigger picture, as long as 1.0515 support holds, rise from 0.9534 (2022 low) would still extend higher. Sustained break of 61.8% retracement of 1.2348 (2021 high) to 0.9534 at 1.1273 will solidify the case of bullish trend reversal and target 1.2348 resistance next (2021 high).

In the long term picture, focus stays on 55 M EMA (now at 1.1131). Rejection by this EMA will revive long term bearishness. However, sustained break above here will be affirm the case of long term bullish reversal and target 1.2348 resistance for confirmation.