Australian Dollar drops broadly today after RBA hints at more monetary easing next month. It’s also weighed down by mixed job data, as well as weaker risk sentiments. It now appears that US politicians won’t agree to a new stimulus deal before election. US stock indices struggled to get through record highs while Asian markets also weaken. As for today, Euro is the stronger one followed by Swiss Franc. Over the week, Yen and Dollar are now the strongest while Aussie and Euro are the weakest.

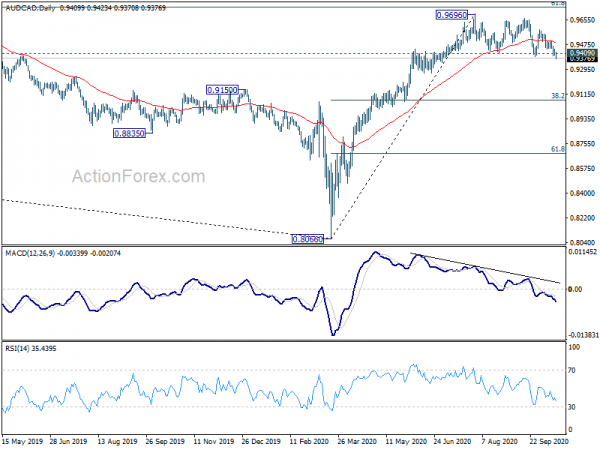

Technically, Aussie is starting to look vulnerable as AUD/CAD appears to be taking out 0.9409 support decisively. That would confirm the start of a correction to rise from 0.8066 to 0.9696, targeting 38.2% retracement. After some unexpected volatility, AUD/NZD should also be resuming the corrective fall from 1.1043 towards 1.0565 support. 0.7095 support in AUD/USD would be watched to confirm return of near term bearishness. But the big level would be the 1.6586 resistance in EUR/AUD.

In Asia, Nikkei closed down -0.51%. 10-year JGB yield is down -0.0053 at 0.026. Hong Kong HSI is down -1.22%. China Shanghai SSE is up 0.02%. Singapore Strait Times is down -0.61%. Overnight, DOW dropped -0.58%. S&P 500 dropped -0.66%. NASDAQ dropped -0.80%. 10-year yield dropped -0.005 to 0.722. Treasury yields could be a focus today too, in particular, whether German 10-year yield would approach -0.6% handle and whether US 10 year yield could defend 0.7% handle.

RBA Lowe hints at more easing in November

RBA Governor Philip Lowe hinted in a speech that the central bank is ready for deliver more monetary easing in the upcoming meeting in November. He noted that “as the economy opens up, though, it is reasonable to expect that further monetary easing would get more traction than was the case earlier.”

Lowe also noted that that financial stability considerations “have changed somewhat”. To the extent that an easing of monetary policy helps people get jobs it will help private sector balance sheets and lessen the number of problem loans. In so doing, it can reduce financial stability risks.”

Also, while RBA’s balance sheet has “increased considerably” since March, “large increases have occurred in other countries. RBA is “considering the implications os this as we work through out own options”.

Lowe’s comments are in line with market expectations of another cut in cash rate to 0.10%, with expansion of asset purchases to longer maturities.

Australia employment dropped -29.5k in Sep, unemployment rate rose to 6.9%

Australia employment dropped -29.5k in September, better than expectation of -50k. Full-time jobs dropped -20.1k while part-time jobs decreased by -9.4k. Unemployment rate rose 0.1% to 6.9%, below expectation of 7.1%. But at the same time, participation rate dropped -0.1% to 64.8%.

US Mnuchin still far apart with Democrats on fiscal stimulus

US Treasury Secretary Steven Mnuchin indicated in an interview that he’s still “far part” with the Democrats on the next fiscal stimulus deal. Politics were “part of the reality” and an agreement is unlikely before US election, even though he will keep trying.

“The president has said to me, keep at this until you get this done,” Mnuchin told Fox Business Network. “If we don’t get it now, when the president wins the election we’ll get it passed quickly afterwards.”

Drew Hammill, deputy chief of staff for House Speaker Nancy Pelosi, said the talks between Mnuchin and Pelosi were “productive”. Staff would continue to “exchange paper” and the two will speak again on Thursday.

Fed Kaplan: Work needed to help disproportionately affected groups back into labor force

Dallas Fed President Robert Kaplan expects the US economy to contract -2.5% this year, and grow around 3.5% next. Unemployment is expected to end the year between 7% and 7.5%. However, unemployment may not drop back below 4% until 2023.

Kaplan is concerned that “many of the folks who have lost their jobs may not have a business to go back to.” “We’re going to have a lot of work to do to get these underrepresented groups that have been disproportionately affected back into the labor force.”

Elsewhere

China CPI slowed to 1.7% yoy in September, down from 2.4% yoy, missed expectation of 1.9% yoy. PPI ticked down to -2.1% yoy, down from -2.0% yoy, missed expectation of -2.0% yoy. Japan tertiary industry index rose 0.8% mom in August, way better than expectation of -0.3% mom.

Swiss will release PPI in European session. Canada will release ADP employment later in the day. US will release Empire State and Philly Fed manufacturing, jobless claims and import prices.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7146; (P) 0.7169; (R1) 0.7184; More…

AUD/USD’s fall from 0.7243 extends lower but stays above 0.7095 support. Intraday bias remains neutral first. Another rise could still be seen as long as 0.7095 support holds. On the upside, above 0.7243 will extend the rebound from 0.7005 to retest 0.7413 high. Decisive break there will resume larger rise form 0.5506 to 0.7635 fibonacci level. However, firm break of 0.7095 will argue that corrective fall from 0.7413 is resuming. Intraday bias will be turned back to the downside for 0.7005, and then 38.2% retracement of 0.5506 to 0.7413 at 0.6685.

In the bigger picture, while rebound from 0.5506 was strong, there is not enough evidence to confirm bullish trend reversal yet. That is, it could be just a corrective inside the long term up trend. Sustained trading back below 55 week EMA (now at 0.6898) will favor the bearish case and argue that the rebound has completed. Focus will be turned back to 0.5506 low. On the upside, break of 0.7413 will extend the rise from 0.5506 to 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:00 | AUD | Consumer Inflation Expectations Oct | 3.40% | 3.10% | ||

| 0:30 | AUD | Employment Change Sep | -29.5K | -50K | 111K | 129.1K |

| 0:30 | AUD | Unemployment Rate Sep | 6.90% | 7.10% | 6.80% | |

| 1:30 | CNY | CPI Y/Y Sep | 1.70% | 1.90% | 2.40% | |

| 1:30 | CNY | PPI Y/Y Sep | -2.10% | -2.00% | -2.00% | |

| 4:30 | JPY | Tertiary Industry Index M/M Aug | 0.80% | -0.30% | -0.50% | -0.10% |

| 6:30 | CHF | Producer and Import Prices M/M Sep | 0.20% | -0.40% | ||

| 6:30 | CHF | Producer and Import Prices Y/Y Sep | -3.50% | |||

| 12:30 | CAD | ADP Employment Change Sep | -205.4K | |||

| 12:30 | USD | Empire State Manufacturing Index Oct | 16.5 | 17 | ||

| 12:30 | USD | Philadelphia Fed Survey Oct | 15.5 | 15 | ||

| 12:30 | USD | Initial Jobless Claims (Oct 9) | 810K | 840K | ||

| 12:30 | USD | Import Price Index M/M Sep | 0.40% | 0.90% | ||

| 14:30 | USD | Natural Gas Storage | 75B | |||

| 15:00 | USD | Crude Oil Inventories | 0.5M |