The forex markets turn quiet in Asian session today. While DOW surged to new record high overnight, S&P 500 and NASDAQ closed slower. Asian markets are also mixed. Investors are holding their bets for now, awaiting FOMC minutes and, more importantly, US non-farm payrolls later in the week. For now, Yen remains overwhelmingly the worst performer following strong rally in treasury yields. Sterling is the strongest one with help from buying against Euro. Dollar is the second strongest it’s still stuck in range except versus Yen.

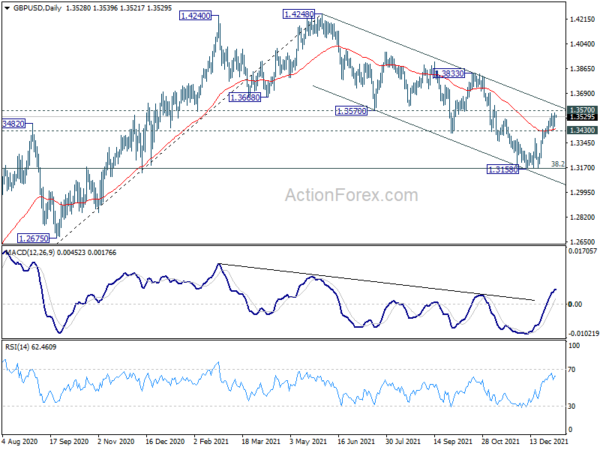

Technically, we’ll keep an eye on GBP/USD for the next few days. It’s now closely a key resistance zone between 1.3570 and channel resistance at 1.3606. We’re seeing corrective fall from 1.4248 as complete with three waves down to 1.3158, after hitting 1.3164 medium term fibonacci level. Sustained break of the mentioned resistance zone will solidify this bullish case. However, rejection by the resistance zone will revive near term bearishness for another test on 1.3164. Sterling trade could make up their minds soon.

In Asia, at the time of writing, Nikkei is flat. Hong Kong HSI is down -0.78%. China Shanghai SSE is down -0.78%. Singapore Strait Times is down -0.29%. Japan 10-year JGB yield is down -0.001 at -0.088. Overnight, DOW rose 0.59% to new record high at 36799.65. S&P 500 dropped -0.06%. NASDAQ dropped -1.33%. 10-year yield rose 0.040 to 1.668.

Fed Kashkari: Threshold for rate hike could be met with Apr 2022 inflation data

Minneapolis Fed President Neel Kashkari said in an essay that he supported Fed’s decision to increase the speed of tapering back in December FOMC meeting. Also, it brought forward two rate hikes into 2022 because “inflation has been higher and more persistent than I had expected.”

Kashkari added, he’d prefer the forward guidance to commit to keeping federal funds rate at effective lower bound “until 12-month core PCE had exceeded 2 percent for 12 months.” Based on this criteria, “the test that I preferred will likely be met when the April 2022 data are released the following month”. The “threshold” (not trigger) for lift off would then be met.

Dollar index range bound with bullish bias ahead of FOMC minutes

Minutes of the December FOMC meeting will be a major focus today. Back then, Fed decided to speed up tapering and end it in March instead of June. Also, the new projections saw three rate hikes this year. The markets would like to see more in-depth information an related discussion, and hints on the timing of the first hike. Currently, Fed fund futures are already pricing in nearly 60% chance that federal funds rate will be raised to 0.25-0.50% and above in March.

Dollar index is staying well in range of 95.51/96.93, much reflecting the movements in EUR/USD. With 95.51 support intact, further rally is expected in DXY, and an upside breakout could come as soon as a reaction to non-farm payroll report this week. A set of strong job numbers could easily push DXY through 61.8% retracement of 102.99 to 82.0 at 97.72. In the case, 100 handle would be within reach very soon.

Gold resilient, back above 1800 after brief dip

Gold dipped notably after hitting 1831.66, following Dollar’s rally. But Gold remains resilient so far, holding above 1789.31 support, and it’s back above 1800 handle. Further rally is still in favor and break of 1831.66 will resume the rally from 1752.32 towards 1877.05 resistance next.

Nevertheless, we’re still seeing Gold as being a leg inside the range pattern from 1676.65. While a break of 1877.05 cannot be ruled out, we’re not seeing much chance of breaking through 1916.30 medium term resistance. Meanwhile, break of 1789.31 support will argue that fall from 1877.05 is probably ready to resume through 1752.32.

On the data front

Japan monetary base rose 8.3% yoy in December. Eurozone PMI services final are the main feature in European session. Later in the day, US will release ADP employment. Canada will release building permits and new housing price index.

USD/JPY Daily Outlook

Daily Pivots: (S1) 115.50; (P) 115.93; (R1) 116.56; More…

Intraday bias in USD/JPY remains on the upside for 61.8% projection of 109.11 to 115.51 from 112.52 at 116.47. Firm break there will extend the up trend from 102.58 to 100% projection at 118.90, which is close to 118.65 long term resistance. On the downside, below 115.64 minor support will turn intraday bias neutral and bring some consolidations, before staging another rally.

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high). Sustained break there will pave the way to 120.85 (2015 high) and raise the chance of long term up trend resumption. For now, this will remain the favored case as long as 112.52 support holds, in case of deep pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Dec | 8.30% | 9.30% | ||

| 05:00 | JPY | Consumer Confidence Dec | 40.9 | 39.2 | ||

| 08:45 | EUR | Italy Services PMI Dec | 53.7 | 55.9 | ||

| 08:50 | EUR | France Services PMI Dec F | 57.1 | 57.1 | ||

| 08:55 | EUR | Germany Services PMI Dec F | 48.4 | 48.4 | ||

| 09:00 | EUR | Eurozone Services PMI Dec F | 53.3 | 53.3 | ||

| 13:15 | USD | ADP Employment Change Dec | 358K | 534K | ||

| 13:30 | CAD | Building Permits M/M Nov | 1.50% | 1.30% | ||

| 13:30 | CAD | New Housing Price Index M/M Nov | 0.70% | 0.90% | ||

| 14:45 | USD | Services PMI Dec F | 57.5 | 57.5 | ||

| 15:30 | USD | Crude Oil Inventories | -2.7M | -3.6M | ||

| 19:00 | USD | FOMC Minutes |