Dollar rises against Yen after release of slightly better than expected ISM manufacturing data. But there is no clear pick up in buying against other major currencies. Weakness in Yen remains in the main theme. Overall trading is relatively subdued today, with most markets closed on holiday. But volatility will certain come back with lots of heavy weight events scheduled, including three central bank meetings in RBA, Fed and ECB.

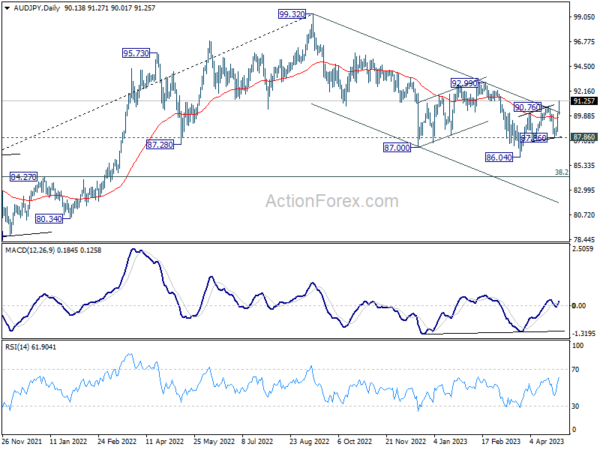

Australian Dollar recovers broadly today as traders await tomorrow’s RBA rate decision. Technically, the turnaround in AUD/JPY in the last two days was very impressive. The break of 90.76 resistance, as well as channel resistance, now argues that whole correction from 99.32 has completed with three waves down to 86.04. Further rally is now expected as long as 55 D EMA (now at 89.76) holds. Break of 92.99 structural resistance will be a strong bullish sign. Let’s see if RBA could give the cross a hand.

US ISM manufacturing rose to 47.1, sixth month of contraction

US ISM Manufacturing PMI rose from 46.3 to 47.1 in April, above expectation of 46.6. Looking at some details, new orders rose from 44.3 to 45.7. Production rose from 47.8 to 48.9. Employment rose from 46.9 to 50.2. Prices rose from 49.2 to 53.2.

ISM said: “This is the sixth month of contraction and continuation of a downward trend that began in June 2022. Of the five subindexes that directly factor into the Manufacturing PMI, only one (Employment) is in growth territory.”

“The past relationship between the Manufacturing PMI and the overall economy indicates that the April reading (47.1 percent) corresponds to a change of minus-0.6 percent in real gross domestic product (GDP) on an annualized basis.”

China’s manufacturing PMI contracts for first time this year

Released over the weekend, China official PMI Manufacturing fell from 51.9 to 49.2 in April, below expectation of 51.4. The readings was alos back below 50-mark, the first contraction reading this year.

A sub-index to measure new orders dipped to 48.8 from 53.6, indicating decline in market demand and acting as a major contributor to the fall in the headline indicator. New export orders edged down to 47.6 from 50.4, hitting the lowest level in three months.

“A lack of market demand and the high-base effect from the quick manufacturing recovery in the first quarter” were among factors that led to the contraction in April, said senior NBS statistician Zhao Qinghe.

Production in the chemical fibre, ferrous metal mining and processing sectors have slowed due to weak market demand, while special equipment and electrical and mechanical equipment sectors have continued to expand, NBS said in a separate statement.

PMI Services fell from 58.2 to 56.4, below expectation of 57.0, but was still the second highest reading this year.

The composite PMI, which includes manufacturing and non-manufacturing activity, dropped to 54.4 from 57.0.

Japan’s PMI manufacturing finalized at 49.5, sector remains in contraction

Japan’s PMI Manufacturing for April was finalized at 49.5, marginally above March’s 49.2, marking the sixth consecutive month of contraction in the sector. Jibun Bank noted that new order volumes displayed further signs of stabilization, while output charges experienced their strongest rise in five months. Additionally, input delivery times only lengthened slightly.

Usamah Bhatti, an economist at S&P Global Market Intelligence, commented that the Japanese manufacturing sector remained in contraction territory at the start of Q2 2023. However, the rate of deterioration eased to the softest in the current six-month sequence, primarily due to the slowest reduction in new order inflows since July of last year.

Bhatti further observed that firms reported supply chains continued on the path to normalization, with the softest lengthening in delivery times in the current 39-month sequence. Inflationary pressures remained historically high, but manufacturers signaled that input prices rose at the softest pace since August 2021. To protect profit margins, firms increasingly passed higher cost burdens onto customers, resulting in charge inflation accelerating to a five-month high.

RBA, FOMC, ECB, ISM, NFP… and so on…

This week, three major central banks are set to meet, with RBA expected to pause for the second consecutive meeting, leaving cash rate unchanged at 3.60%. But this is far from being a full consensus, with around a third of analysts still anticipating a rate hike. Regardless of the outcome, focus will be on RBA’s new economic projections outlined in the Statement on Monetary Policy, which will shape market expectations moving forward.

FOMC is widely anticipated to continue tightening by increasing the federal funds rate by 25bps to 5.00-5.25%. The majority of market participants expect Fed to enter a pause phase following this hike. The key question now centers on when Fed will begin reversing tightening with rate cuts, with speculation pointing to a potential start in November. However, Fed’s economic projections and dot plot will not be available until June, leaving some uncertainty.

Opinions are divided on whether ECB will opt for a 25bps or 50bps hike this time, but the primary concern is how long the tightening will continue. Current expectations suggest additional hikes until September, the end of summer. But IMF European Department head Alfred Kammer just threw out an idea durign the weekend that ECB should continue tightening until mid-2024. Ultimately, ECB’s next decisions will remain data-dependent, on meeting-by-meeting basis, and be influenced by economic projections to be completed in June.

In addition to central bank decisions, the calendar is packed with crucial data releases, including US non-farm payrolls and ISMs, Eurozone CPI flash, Canada employment, New Zealand employment, Australia retail sales and trade balance, and China Caixin PMIs, etc.

Here are some highlights for the week:

- Tuesday: RBA rate decision, Japan monetary base; Germany retail sales; Swiss SECO consumer climate, PMI manufacturing; Eurozone PMI manufacturing final, M3 money supply, CPI flash; UK PMI manufacturing final; US factory orders.

- Wednesday: New Zealand employment; Australia retail sales; Eurozone unemployment rate; US ADP employment, ISM services, FOMC rate decision.

- Thursday: New Zealand building permit; Australia trade balance; China Caixin PMI manufacturing; Germany trade balance; Eurozone PMI services final, PPI, ECB rate decision; UK PMI services final, M4 money supply, mortgage approvals; Canada trade balance, Ivey PMI; US jobless claims, non-farm productivity, trade balance.

- Friday: China Caixin PMI services; Swiss unemployment rate, CPI, foreign currency reserves; Germany factory orders; France industrial production; UK PMI construction; Eurozone retail sales; Canada employment; US non-farm payrolls.

USD/JPY Daily Outlook

Daily Pivots: (S1) 134.42; (P) 135.49; (R1) 137.38; More…

USD/JPY’s rally continues today and intraday bias remains on the upside for 137.90 resistance. Break there will resume whole rebound from 127.20, and target 100% projection of 127.20 to 137.90 from 129.62 at 140.32. On the downside, below 135.13 support will turn intraday bias remains neutral first. But further rally will remain in favor as long as 133.00 support holds, in case of retreat.

In the bigger picture, price actions from 151.93 high are currently seen as a corrective pattern to the long term up trend. The first leg should have completed at 127.20. Rebound from there is seen as the second leg. Sustained break of 31.8% retracement of 151.93 to 127.20 at 136.34 will bring stronger rebound to 61.8% retracement at 142.48. Meanwhile, break of 129.62 will argue that the third leg is starting through 127.20 low.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Manufacturing PMI Apr F | 49.5 | 49.5 | 49.5 | |

| 01:00 | AUD | TD Securities Inflation M/M Apr | 0.20% | 0.30% | ||

| 05:00 | JPY | Consumer Confidence Apr | 35.4 | 35 | 33.9 | |

| 13:30 | CAD | Manufacturing PMI Apr | 50.2 | 50.5 | 48.6 | |

| 13:45 | USD | Manufacturing PMI Apr F | 50.2 | 50.4 | 50.4 | |

| 14:00 | USD | ISM Manufacturing PMI Apr | 47.1 | 46.6 | 46.3 | |

| 14:00 | USD | ISM Manufacturing Prices Paid Apr | 53.2 | 50.4 | 49.2 | |

| 14:00 | USD | ISM Manufacturing Employment Index Apr | 50.2 | 46.9 | ||

| 14:00 | USD | Construction Spending M/M Mar | 0.30% | 0.20% | -0.10% |