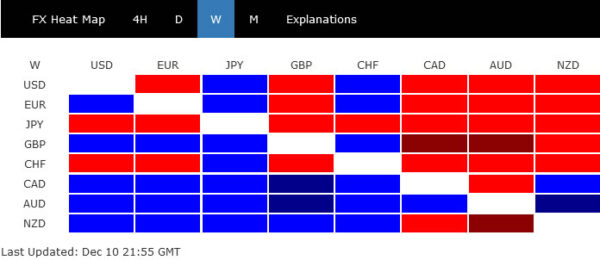

Investors seemed to have already put Omicron risks behind last week, with markets turned back into risk-on mode. But the forex markets were indeed quite mixed. Commodity currencies were the strongest ones, but the rebounds are looking more like corrective. Yen was the worst performer, but the pull-backs were very shallow

Dollar remain stuck in range against European majors and Yen, despite multi-decade high CPI reading. Sterling was pressured for a while on return to pandemic restrictions, but there was no follow through selling. The markets would probably need to see something noticeable from the central bank meetings (Fed, SNB, BoE, ECB, BoJ) this week to set the tone for the rest of the year.

S&P 500 ready to resume up trend after record close?

S&P 500 managed to close at a record high at 4712.02 last week, even though it was short of intraday record at 4743.83. At this point, we’re not too convinced that the correction from 4743.83 has completed at 4495.12. Instead, we’re expecting another falling leg to complete a three-wave pattern. Break of 4631.97 gap support will bring deeper fall to retest 4495.12 at least.

But admittedly, SPX is holding well above medium term rising trend line. So, an imminent up trend resumption cannot be totally ruled out. Firm break of 4743.83 will pave the way to 138.2% projection of 2191.86 to 3588.11 from 3233.94 at 5163.55.

WTI rebounded after defending key support

Positive sentiment was also reflected in the rebound in WTI crude oil. It should have made a short term bottom at 62.43, after defending 61.74 key support level. But it’s also too early to say that it’s reversing the whole fall from 85.41, rather than correcting it. As long as 55 day EMA (now at 75.24) is limiting the rebound, we’d expect at least one more take on 61.74 support.

Yet, sustained trading above 55 day EMA will pave the way to retest 85.41 high, which will be another sign of positive market sentiment.

AUD/JPY’s correction not finished despite rebound

AUD/JPY’s rebound last week suggests that a short term bottom was formed at 78.77. While some more upside is likely for the near term, strong resistance could be seen at around 55 day EMA (now at 82.24), to limit upside.

Break of 78.77 will extend the fall from 86.24, as a correction to whole up trend from 59.85, to 38.2% retracement of 59.85 to 86.24 at 76.15 to complete the correction. That would be in-line with the overall view that risk market up trend is no ready to resume. However, sustained trading above 55 day EMA will dampen this view and bring retest of 86.24 high instead.

EUR/GBP to look into ECB and BoE

EUR/GBP would be an interesting one to watch this week with BoE and ECB featured. In particular, either a rate hike or not, markets could see BoE decision as a surprise.

The crossed breached 0.8593 structural resistance last week but couldn’t sustain above there. For now, further rise is in favor as long as 0.8487 minor support holds. Break of 0.8598 and sustained trading above 0.8593 will be the first sign that whole down trend from 0.9499 is complete. Such development could open up further rally through 0.8656 resistance to 38.2% retracement of 0.9499 to 0.8379 at 0.8807.

However, break of 0.8487 support will likely extend the down trend from 0.9499 with one more leg through 0.8379 low.

USD/JPY awaits Fed’s tapering decision and dot plot

On the other hand, USD/JPY will looking into Fed’s decision and projection to guide a range break out (BoJ will likely be a non-event). The question is now much faster Fed would adjust the tapering plan to, and the pace of rate hike as indicated in the new dot plot. And of course, subsequent reactions in risk sentiment.

While break of 113.94 minor resistance will bring retest of 115.51 high, firm break there will need to be accompanied by confirmed up trend resumptions in stocks. On the other hand, break of 112.52 support will extend the correction from 115.51 to 38.2% retracement of 102.58 to 115.51 at 110.57.

USD/CAD Weekly Outlook

USD/CAD dropped to 1.2604 last week but quickly rebounded. Initial bias remains neutral this week first. On the upside, break of 1.2742 minor resistance will retain near term bullishness and bring retest of 1.2852 first. Break there will resume whole rise from 1.2286 to retest 1.2894/2947 resistance zone. On the downside, however, firm break of 1.2604 will argue that rise from 1.2286 has completed. Deeper fall would be seen back to 1.2286 support.

In the bigger picture, medium term outlook remains neutral for now. The pair drew support from 1.2061 cluster and rebounded. Yet, upside was limited below 38.2% retracement of 1.4667 to 1.2005 at 1.3022. On the upside, firm break of 1.3022 should affirm the case of medium term bullish reversal. However, break of 1.2286 will turn focus back to 1.2005 low again.

In the longer term picture, we’re viewing price actions from 1.4689 as a consolidation pattern. Thus, up trend from 0.9506 (2007 low) is still expected to resume at a later stage. This will remain the favored case as long as 1.2061 support holds, which is close to 50% retracement of 0.9406 to 1.4689 at 1.2048. However, firm break of 1.2061 support will argue that USD/CAD has already started a long term down trend. Next target is 61.8% retracement of 0.9406 to 1.4689 at 1.1424.