We look for the Bank of Canada’s business and consumer surveys on tap next week to show an improvement in sentiment as the survey window (mid-February to early March) predated the latest round of virus resurgence and lockdown measures. Similar to the last iteration, the BOS survey will likely flag an uneven recovery, with weakness centered around high-contact services industries contrasting continued improvement in the rest of the economy through the second wave of virus spread. Manufacturing and wholesale sales both likely edged lower in February after big January gains but sentiment indicators from the Canadian Federation of Independent Business and the Markit PMI flagged further improvements in March.

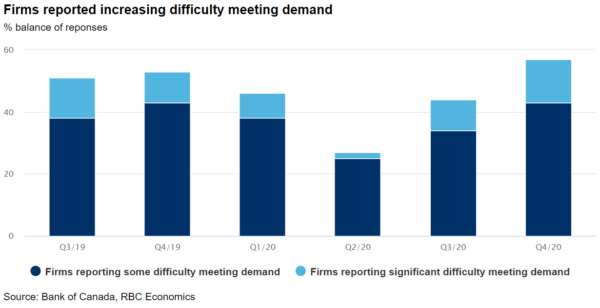

The disparity between sectors has also spawned diverging challenges with some businesses outside the hard-hit industries reportedly bumping up against production capacity limits. Supply constraints underscored by a shortage of sourcing materials and skilled labour inputs (a problem predating the pandemic) are prompting cost pressures and stoking inflation concerns. Businesses’ expectations on input costs, wages and price growth from the BOS survey will be watched closely for signs on changing inflation expectations. Our baseline assumption remains that expectations are well-anchored around central bank’s target.

Week ahead data watch:

- Canadian home resales for March remained exceptionally high given earlier regional reports.

- The US headline inflation rate is expected to jump in March in large part due to weakness in March 2020 when energy prices plummeted. Core (ex-food & energy) price growth has been tracking lower (+1.3% YoY in February) but is expected to firm gradually back around central bank’s target later in 2021.

- US activity indicators, including retail sales, industrial production and housing starts are expected to bounce back from softer February levels, as weather-related softness subsides and rapid vaccination allowed much of the country to lift restrictions and reopen. A preliminary look of consumer sentiment in April will likely sustain a positive outlook as well.