USD remained rather stable against a number of its counterparts yesterday amidst low volatility, broadly in the FX market. There may be some attention for the release of the US international trade balance, yet overall, we expect fundamentals to take the lead regarding the direction of the USD as there are only a few high impact financial releases from the US today. On the other hand, safe haven currencies such as the JPY seem to be under pressure given the positive market sentiment. EUR traders may be keeping an eye out for today’s financial data and beyond Eurozone’s revised GDP rates for Q3, we also tend to note the release of Germany’s forward looking ZEW indicators for December which are expected to drop implying a more pessimistic outlook for the German economy as well as deteriorating conditions. On the monetary front for EUR traders we note the scheduled speech of ECB Vice President De Guindos speaks. US stockmarkets on the other hand seemed to gain as hopes surfaced in the markets that the Omicron variant of the pandemic has mild symptoms allowing for a more risk on attitude to be adopted, yet uncertainty is still present.

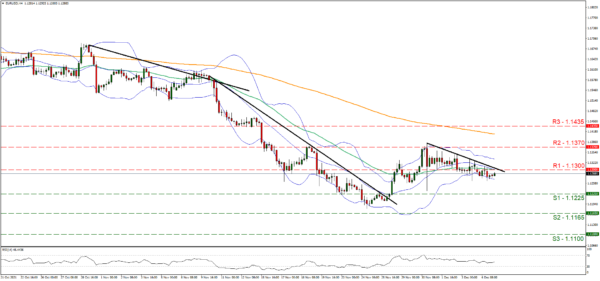

EUR/USD continued its bearish movement just below the 1.1300 (R1) resistance line. We tend to maintain our bearish outlook for the pair as long as it remains below the downward trendline incepted since the 30th of November. On the other hand the reading of the RSI indicator below our 4-hour chart is at near the reading of 50 which could imply that the bears could be having second thoughts. Should the selling interest be maintained, we may see the pair taking aim of the 1.1225 (S1) support line. Should the pair find extensive buying orders along its path we may see it breaking the prementioned downward trendline the 1.1300 (R1) resistance line and take aim of the 1.1370 (R1) resistance level.

Oil rises as Omicron worries tend to ease

Oil prices seemed to gain some ground yesterday and during today’s Asian session as market worries for the Omicron variant of the pandemic tended to ease thus allowing for hopes for the demand side of the commodity to rise. Also on the demand side the fact that China’s oil imports rebounded from Octobers’ lows tended to provide also boost to the notion of the recovery of oil demand in the global market. On the supply side the US-Iran negotiations which could ultimately allow for Iran to mass export oil once again are to have hit an impasse and traders seem to view the supply side as still tight as Iran may be delayed to enter the global oil markets. Also Saudi Arabia is reported to have increased its prices over the weekend in another sign of confidence for the demand side for the commodity, while today Oil traders are to keep a close eye over the release of the weekly US API crude oil inventories figure.

WTI prices rose yesterday breaking clearly the 67.35 (S1) resistance line, now turned to support and continued higher to test the 70.00 (R1) resistance level. We tend to maintain a bullish outlook for the commodity’s prices given also that the RSI indicator below the 4-hour chart has an upward slope and has also surpassed the reading of 50 implying that the bulls have the advantage. Should the bulls actually take charge of the pair’s direction we may see it breaking the 70.00 (R1) resistance line and aim for the 73.45 (R2) resistance level. Should the bears take over we may see the commodity’s price reverse direction and take aim for the 67.35 (S1) support line.

Today’s events and expectations

Today we note the release of UK’s Halifax House prices for November, Germany’s industrial orders for October, Eurozone’s revised GDP Rate for Q3, Germany’s ZEW indicators for December in the European session. In the American session we get the release of the trade balance figures for the US and Canada, both for October, while during tomorrow’s Asian session we get Japan’s current account balance for October and the Revised GDP Rate for Q3.

Support: 1.1225 (S1), 1.1165 (S2), 1.1100 (S3)

Resistance: 1.1300 (R1), 1.1370 (R2), 1.1435 (R3)

Support: 67.35 (S1), 65.00 (S2), 61.70 (S3)

Resistance: 70.00 (R1), 73.45 (R2), 76.60 (R3)