So in terms of the fundamentals driving SPX500 at the moment, the main topic is that of Fed rate cut expectations. In line with a slew of weak data recently, the market is now expecting that the Fed will cut rates when it meets this week. We are possibly looking for a .25% rate cut. Although voting was split more than usual at the September meeting, the deterioration in conditions since then has seen the market adjusting its view. Such a move would be bullish for equities, providing further liquidity for the business environment.

Technical Perspective

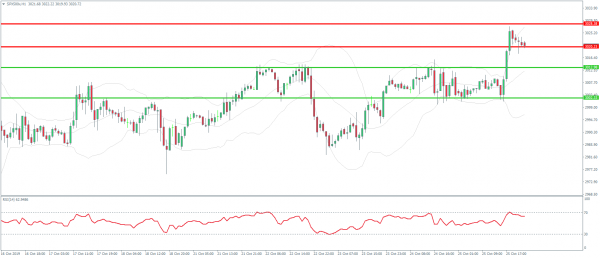

SPX500 is testing the higher timeframe resistance zone between 3020.23-3028.38. If this zone holds, for now, we could see some retracement lower. For shorter-timeframe traders, the key support levels to watch will be the retest of former highs into the 3012.98 level. Beyond that, the retest of lows into the 3002.33 level.