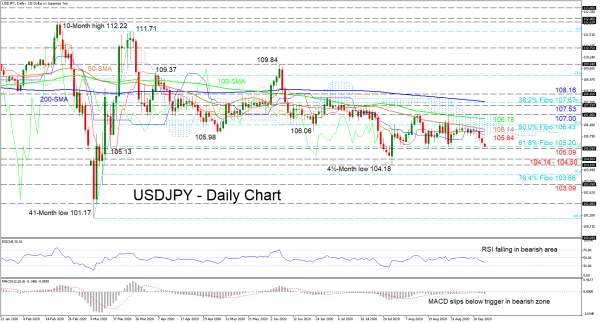

USDJPY continues to be robbed of directional momentum as the pair lingers, controlled by the 105.09 and 107.00 boundaries of a sideways pattern. The Ichimoku lines and the cloud propose minimal difference in price action, while the drifting tone of the simple moving averages (SMAs), reflects little promise in assisting a new direction.

Nonetheless, the short-term oscillators are slightly tilting towards an unfolding negative outcome. The MACD, in the negative region, has dipped below its red trigger line, while the RSI is falling in bearish territory, heading towards the 30 mark.

Successfully pivoting from the floor of the pattern, resistance may originate from the red Tenkan-sen line at 105.84 until the 50-day SMA of 106.14, involving the cloud’s lower band and the blue Kijun-sen line. Slightly above, the 106.43 level may step into the spotlight, that being the 50.0% Fibonacci retracement of the up leg from 101.17 to 111.71. However, should buying interest persist, the 100-day SMA at 106.78 and the nearby ceiling of the range at 107.00, in-line with the cloud’s upper surface, could prove hard to overcome. Subsequently, the section from the 107.53 barrier to the 38.2% Fibo of 107.67, where the 200-day SMA also resides could deny further advances towards the 108.16 peak.

To the downside, immediate hardened support may arise from the 61.8% Fibo of 105.20 to the 105.09 low. If this base of the horizontal structure fails to obstruct further loss of ground, the key support zone of 104.18 to 104.50 may try to dismiss negative tendencies from evolving. Diving deeper though, the attention could shift towards the 76.4% Fibo of 103.66 and the 103.09 trough.

In brief, a break above 107.00 or below 105.09 is required to reveal the next direction in the short-term timeframe.