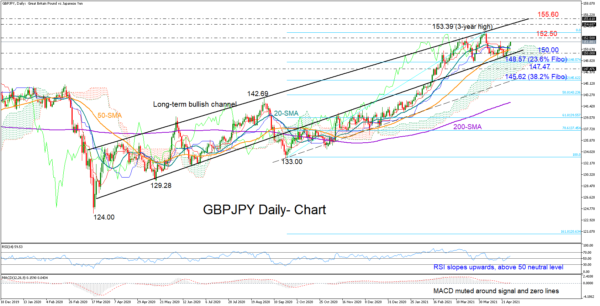

GBPJPY has been in the green over the past five days, gradually crawling towards the 151.00 area since the bounce near the bottom of a long-term channel, which went back into action in March.

The RSI has resumed its upward direction above its 50 neutral level, though the MACD has yet to gain momentum within the positive area, reflecting a cautious bullish bias. Note that the bearish cross between the red Tenkan-sen and blue Kijun-sen lines is still intact.

On the way up, immediate resistance could emerge within the 152.50 – 153.39 area, where the price has previously peaked. Moving higher, the price will likely slow pace near the topline of the channel seen around 154.80 before heading for the crucial 2018 peak of 155.60.

If sellers resurface, the pair will again seek shelter near the channel’s bottom line around 150.00. Failure to hold above that floor could bring the 148.57 level into view – being the 23.6% Fibonacci retracement of the 133.00 – 153.39 up leg. Slightly lower, the 147.47 number managed to add strong footing to the pair back in February and therefore will be closely watched ahead of the 38.2% Fibonacci of 145.62.

In brief, GBPJPY is looking cautiously bullish in the short-term picture, aiming for the key 152.50 – 153.39 area.