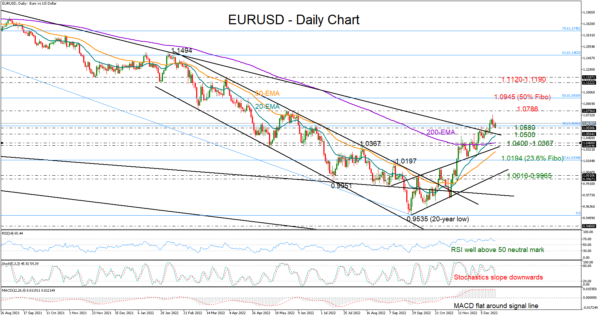

EURUSD opened the week with positive momentum marginally below the 1.0600 level, having slightly trimmed some of its recent gains as overbought signals appeared on the chart.

The RSI keeps fluctuating comfortably above its 50 neutral mark following the pullback below 70, reflecting persisting buying interest, whereas the stochastics and the MACD are looking for a downside reversal, suggesting that some caution is still required.

Yet, with the pair maintaining a clear bullish structure in the short-term picture, which recently expanded above the long-term crucial descending trendline drawn from May 2021, traders may continue the push to higher ground.

The pair is currently building a base around the 1.0580 level, where the 50-period exponential moving average (EMA) is supporting the market in the four-hour chart. A jump into the 1.0700 territory would bring May’s resistance of 1.0786 back on the radar. Running higher, the way would clear for the 50% Fibonacci retracement of the 2021-2022 downtrend at 1.0945. Another victory at this point could see a continuation towards the 1.1120–1.1190 constraining zone.

On the downside, if the 1.0580 floor cracks, the broken descending trendline may defend the bulls with the help of the 20-day EMA around 1.0500. Should the bears win the battle here, the 200-day EMA and the surface of the broken bullish channel could next come to the rescue within the 1.0400–1.0367 area. Note that the 50-day EMA is converging in that territory too. Hence, a decisive close lower could confirm another leg down to the 23.6% Fibonacci of 1.0194. If the latter proves fragile, the bearish phase could last till the channel’s lower boundary seen at 1.0010.

In brief, EURUSD has the foundation to move further north despite some weakness in sentiment. For that to happen, the 1.0580 base will need to stand firm.