Global stock market crash continues today as total coronavirus cases are set to break 130k level very soon. Sentiments were rocked by US unilateral ban of European travellers, which also prompted EU condemnation. US stock futures hit limit down and stocks are set to follow other markets to open with a gap low. The highly anticipated ECB announcement was some what a disappointment and triggers little reactions.

In the currency markets, massive sell-off is seen in Australian and New Zealand Dollar today, while Sterling is not far behind. Yen continues to rise on risk aversion but Dollar’s strength is worth a note. AUD/USD breaks 0.6433 support to resume long term down trend. 2008 low at 0.6008 is a medium term target, but that could be hit rather soon. GBP/USD’s break of 1.2725 support also indicates resumption of fall form 1.3514, towards 1.2552 near term fibonacci level next. EUR/USD, despite this week’s retreat, is still holding above 1.1095 support and thus stays near term bullish. We’ll see which way it’s heading to.

Regarding coronavirus pandemic, total cases reach 129,185, with 4749 deaths. Italy (12,462 cases, 827 deaths) and Iran (10,075 cases, 429 deaths) remain the two largest epicenter currently. South Korea is risking a second wave of outbreak, with 7869 cases and 66 deaths. Spain (2964 cases, 84 deaths), France (2281 cases, 48 deaths) and France (2120 cases, 4 deaths), are closely watched. US has so far reported 1,355 cases with 38 deaths. China, the original of this world wide pandemic, has a accumulated of 80796 cases and 3169 deaths. (A doctor in Wuhan has spoken out in an interview regarding how she was reprimanded back in December, that eventually lead to the current global spread. Here’s a Guardian report for English readers.)

In Europe, currently, FTSE is down -6.75%. DAX is down -7.35%. CAC is down -7.88%. German 10-year yield is up 0.001 at -0.741. Earlier in Asia, Nikkei dropped -4.41%. Hong Kong HSI dropped -3.66%. China Shanghai SSE dropped -1.52%. Singapore Strait Times dropped -3.77%. Japan 10-year JGB yield dropped -0.0061 to -0.069.

ECB announces coronavirus response package without rate cut

ECB left interest rates unchanged today. That is, main refinancing rate is held at 0.00%, marginal lending facility rate at 0.25%, deposit facility rate at -0.50%. In response to coronavirus pandemic, ECB decided a package of measures. There will be additional longer-term refinancing operations (LTROs) to provide liquidity support. In TLTROIII, considerably more favorable terms will be applied during the period from June 2020 to June 2021. Also, a temporary envelop of additional net asset purchases of EUR 120B will be added until the end of the year. Full statement here.

Eurozone industrial production rose 2.3% in Jan, above expectation of 1.2%

Eurozone industrial production rose 2.3% mom in January, well above expectation of 1.2% mom. Production of intermediate goods rose by 3.2% mom, capital goods by 2.6% mom, non-durable consumer goods by 0.8% mom and durable consumer goods by 0.7% mom, while production of energy fell by -0.1% mom.

EU27 industrial production rose 2.0% mom. Among Member States for which data are available, the highest increases in industrial production were registered in Ireland (+5.7%), Hungary (+4.6%) and Slovakia (+4.5%). The largest decreases were observed in Denmark (-2.1%), Latvia (-1.9%) and Lithuania (-1.8%).

Ifo: 56.2% of German companies negatively affected by coronavirus

Ifo Institute said 56.2% of German companies are suffering from negative impacts of coronavirus epidemic. Only 2.2% of all companies reported a positive impact. Situation is worst for tour operators and travel agencies, with 96% negative affected.

In manufacturing, 63% reported negative impacts. 76.4% said business trips were canceled or delayed. 52.0% noted difficulties in supply of preliminary products or raw materials. Companies in the electrical, mechanical engineering, furniture and chemical industries are most affected.

In trade, 63% are negatively affected. 65.9% said there are delays or failure of deliveries in purchasing. 58.7% noted decline in demand.

BoJ Kuroda pledges appropriate policy actions again after meeting PM Abe

Japan Prime Minister Shinzo Abe and BoJ Governor Haruhiko Kuroda held a meeting today, just ahead of next week’s monetary policy meeting. After the meeting, Kuroda said the central bank has already been providing ample liquidity and steeping up asset purchases to counter recent market moves, which fluctuate “widely. He related that “we’ll take appropriate steps as necessary in a timely manner, while closely monitoring developments.”

Released earlier in Japan, large manufacturer sentiment dropped to a near nine-year low in Q1. The BSI large manufacturers index dropped to -17.2, down from -7.8, worst since 2011. Nevertheless, outlook in Q2 in expected to improve to -5.5, and then 6.1 in Q3.

US initial jobless claims dropped to 211k, PPI slowed

US initial jobless claims dropped -4k to 211k in the week ending March 6, below expectation of 215k. Four-week moving average of initial claims rose 1.25k to 214k. Continuing claims dropped -11k to 1.722m in the week ending February 29. Four-week moving average of continuing claims rose 5.25k to 1.728m.

PPI final demand came in as -0.6% mom, 1.3% yoy in February, versus expectation of -0.1% mom, 1.9% yoy. PPI core was at -0.3% mom, 1.4% yoy, versus expectation of 0.2% mom, 1.7% yoy.

EUR/USD Mid-Day Outlook

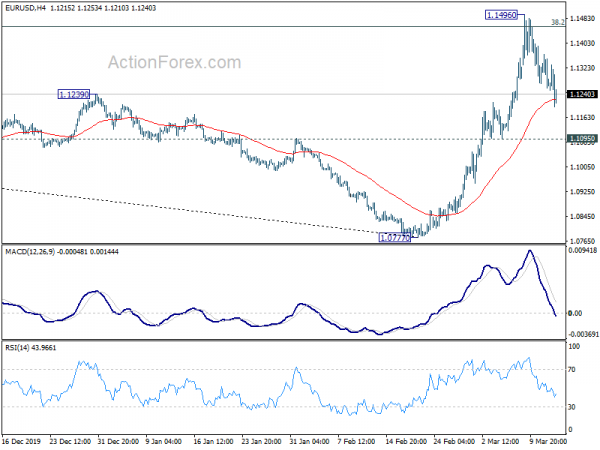

Daily Pivots: (S1) 1.1231; (P) 1.1299; (R1) 1.1340; More…

EUR/USD’s retreat from 1.1496 extends today but it’s staying above 1.1095 support so far. Intraday bias remains neutral and another rise is in favor. On the upside, sustained break of 1.1496 will pave the way to next fibonacci level at 1.1876. However, firm break of 1.1096 will argue that whole rebound form 1.0777 has completed. Intraday bias will be turned back to the downside for retesting 1.0777 low.

In the bigger picture, a medium term bottom should have formed at 1.0777 after drawing support from 78.6% retracement of 1.0339 (2017 low) to 1.2555 at 1.0813. Sustained break of 38.2% retracement of 1.2555 to 1.0777 at 1.1456 will raise the chance of medium term bullish reversal and target 61.8% retracement at 1.1876. Rejection by 1.1456 will suggests that price actions from 1.0777 are merely a correction. Another fall below 1.0777 low would be seen at a later stage in this case.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Feb | 0.80% | 1.00% | 1.70% | 1.50% |

| 00:00 | AUD | Consumer Inflation Expectations Mar | 4.00% | 4.00% | ||

| 00:01 | GBP | RICS Housing Price Balance Feb | 29% | 20% | 17% | 18% |

| 10:00 | EUR | Eurozone Industrial Production M/M Jan | 2.30% | 1.20% | -2.10% | -1.80% |

| 12:30 | USD | PPI M/M Feb | -0.60% | -0.10% | 0.50% | |

| 12:30 | USD | PPI Y/Y Feb | 1.30% | 1.90% | 2.10% | |

| 12:30 | USD | PPI Core M/M Feb | -0.30% | 0.20% | 0.50% | |

| 12:30 | USD | PPI Core Y/Y Feb | 1.40% | 1.70% | 1.70% | |

| 12:30 | USD | Initial Jobless Claims (Mar 6) | 211K | 215K | 216K | 215K |

| 12:45 | EUR | ECB Interest Rate Decision | 0% | 0% | 0% | |

| 12:45 | EUR | ECB Deposit Rate Decision | -0.50% | -0.50% | -0.50% | |

| 13:30 | EUR | ECB Press Conference | ||||

| 14:30 | USD | Natural Gas Storage | -109B |