Summary

The drop in March Consumer Confidence tells us that while households are not overly pessimistic on current conditions, they’re growing increasingly worried about the future—particularly when it comes to employment prospects and their income.

Slippery Slope

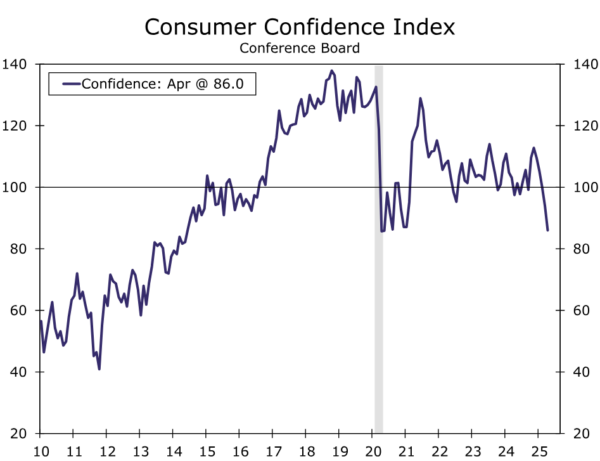

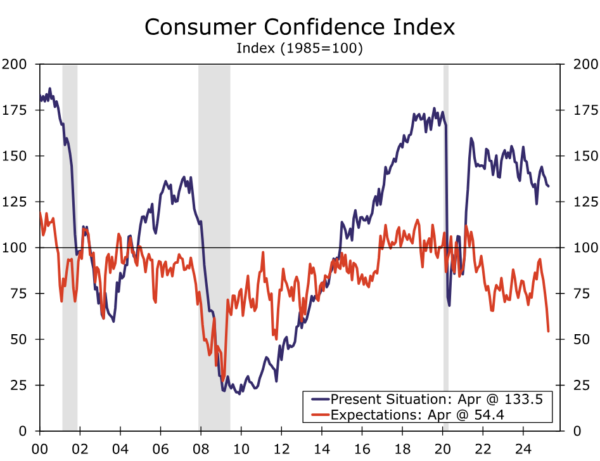

Consumers are growing more and more anxious about their financial situation. The Conference Board’s Consumer Confidence Index slipped for the fifth-straight month to 86.0 in March, which rivals the lows hit during the pandemic (chart). While households have grown more uneasy about their current situation, decreased expectations around the future is what’s driving optimism lower today. The present situation index slipped to 133.5, which is only about eight percentage points off its post-pandemic average, while at 54.4 the expectations index is comfortably in the low-end of its recent range (chart).

It’s not hard to justify consumer angst today. Talk around tariffs has spooked consumers into believing inflation will be higher in the future, and its depressed their expectations around the economy generally. Inflation expectations are up, with the median by this measure reaching 6% in April, or the highest since mid-2022. The separate Consumer Sentiment report out of the University of Michigan more closely tracks household feelings around financial metrics, like expectations around inflation. This Confidence report is a better gauge of business conditions and employment.

To that end, an increasing share of households (34.8%) expect business conditions to worsen in the next six months, while more households (18.2%) also expect income to weaken. For the first time since July 2022, more households expect income to decrease than increase in the next six-months.

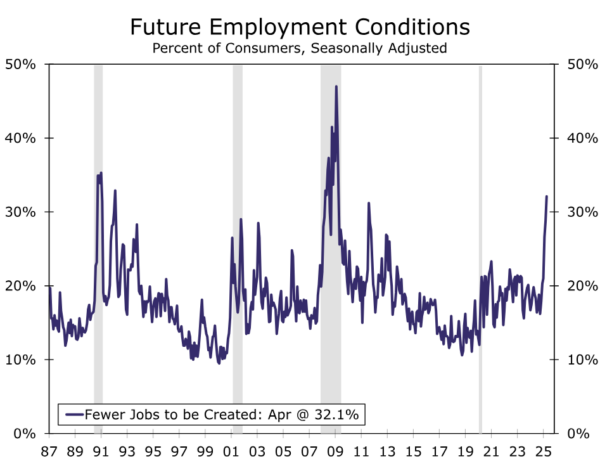

This all stems from fear of job prospects. Consumer views on the labor market weakened in April, revealing broad worry about the outlook for future employment conditions. The labor differential, or the share of consumers reporting jobs as “plentiful” less those reporting jobs as “hard to get,” fell to 15.1%, its lowest reading in seven months. The 2.4 percentage point drop from 17.5% in March was driven both by a decrease in those reporting jobs as plentiful and an increase in those reporting them as hard to get. Further, the share of consumers expecting there to be fewer jobs created over the next six months rose to 32.1% in April from 28.8% in March—this gauge of labor market expectations is now higher than at any time since 2009 (chart).

Current data suggest the labor market remains stable. While businesses aren’t hiring as much, they’re not laying off workers in droves either—the level of job openings in the economy continues to subside, but claims for unemployment insurance remain in-check. While a further deterioration in the labor market would force a pull back in consumer spending, continued uncertainty could be enough to spook consumers. Pessimism can be a slippery slope.