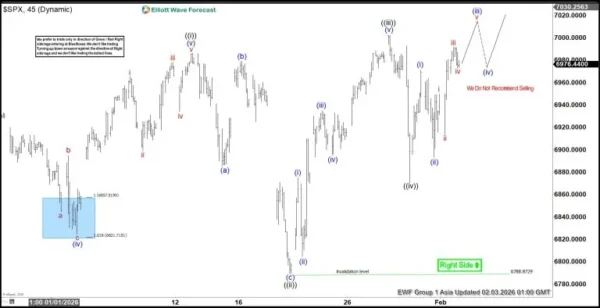

The S&P 500 (SPX) continues to advance as it works toward completing a diagonal Elliott Wave structure that began at the November 21, 2025 low. From that level, wave ((i)) pushed higher and ended at 6986.33. The market then entered wave ((ii)), which unfolded as a clear zigzag. Wave (a) declined to 6885.74, while wave (b) recovered to 6979.34. Wave (c) extended lower and finished at 6788.87, completing wave ((ii)) at a higher degree.

Following this correction, the Index resumed its upward trajectory in wave ((iii)), which progressed toward 7002.28. A pullback in wave ((iv)) later developed and concluded at 6870.8. The structure has since shifted into wave ((v)), which is advancing with an internal subdivision that aligns with an impulsive pattern at the lesser degree. From the wave ((iv)) low, wave (i) rose to 6971.09, and wave (ii) retraced to 6893.48.

The broader bullish outlook remains intact while the pivot at 6788.87 holds. As long as this level stays protected, any pullback is expected to attract buyers within a three‑ or seven‑swing sequence. This behavior supports the potential for further upside as the diagonal structure continues to mature. The overall pattern maintains its integrity and reinforces the view that the Index retains scope for additional strength in the near term.

S&P 500 (SPX) 45 minute chart

SPX Elliott Wave video:

You are currently viewing a placeholder content from Default. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.