European equity markets are poised to start the week on a positive note on Monday after the first round of the French elections suggested that the populist wave that engulfed the UK and US in 2016 has not quite breached the borders of the eurozone countries.

While it’s clear that populism is growing in the region as it is elsewhere, the victory for Emmanuel Macron in the first round may well have crushed the chances of Marine Le Pen in two weeks’ time. Even when the polls had Le Pen taking the first round, Macron was comfortably expected to win the head to head but with the centrist candidate having toppled her on Sunday, the leader of the National Front would appear to have a monumental job on her hands.

While the result on Sunday was largely in line with what the latest polls had been projecting, we did see a more cautious approach from investors heading into it having learned their lessons from last year. The relief rally in the euro overnight are a clear sign of this, with it having hit its late March highs above 1.09 against the dollar before paring gains.

Obviously there is still two weeks to go until the second round of voting and while Macron looks highly likely to succeed, the populist vote has surprised us in the past and may well again. It will be interesting to see whether the same complacency that left us surprised last June – when the UK voted to leave the EU – creeps back into the markets in the coming weeks or if the same caution that spurred the relief rally overnight lingers.

French President Marcon, in waiting

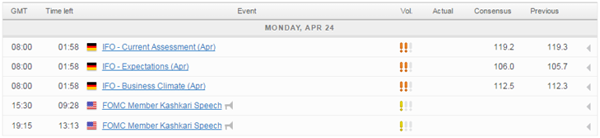

With this week and particularly today looking a little quiet on the economic calendar – barring the ECB meeting on Thursday and a couple of other releases – we’re likely to see focus remain on the situation in France and Le Pen’s efforts to prove the pollsters wrong. As was the case in the Netherlands, the first round of voting will be seen as a success for those seeking the status quo in the eurozone and with the AfD in Germany standing little chance in September, a similar result in two weeks may see the region survive the year unscathed. Assuming, of course, we don’t see elections in Italy.