For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.1682 on Friday.

In the US, data showed that the US preliminary Reuters/Michigan consumer sentiment index eased to a level of 97.1 in July, amid concerns over the impact of recent tariffs on the economy. Markets had expected the index to drop to a level of 98.0. In the prior month, the index had recorded a level of 98.2.

The Federal Reserve, in its semi-annual Monetary Policy Report, indicated that the US economic activity increased “at a solid pace” over the first half of this year and reiterated the central bank’s expectations for gradual rate hikes. However, the report highlighted concerns over domestic and global risks from trade tensions and increasing oil prices.

In the Asian session, at GMT0300, the pair is trading at 1.1682, with the EUR trading flat against the USD from Friday’s close.

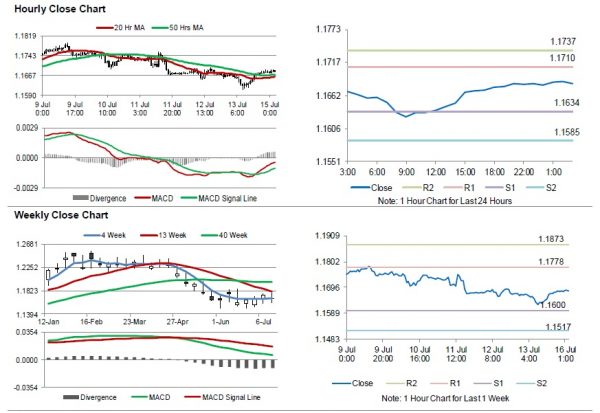

The pair is expected to find support at 1.1634, and a fall through could take it to the next support level of 1.1585. The pair is expected to find its first resistance at 1.1710, and a rise through could take it to the next resistance level of 1.1737.

Moving ahead, investors would await the Euro-zone’s trade balance data for May, due to be released in a few hours. Also, the US advance retail sales for June and the NY Empire State manufacturing index for July, slated to release later in the day, will keep traders on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.