Trump Administration Playing Hardball Ahead of NAFTA renegotiation

The Canadian dollar is lower against the greenback after early tweeting from US President Trump and a confirmation later by the Department of Commerce on new tariffs against Canadian softwood lumber producers. Commerce Secretary Wilbur Ross said that Canada has been a “generally a good neighbour, but that doesn’t mean they don’t have to play by the rules”. The US is targeting five Canadian lumber exporters of receiving subsidies making it hard for US producers to compete.

Secretary Ross wanted to get the lumber dispute out of the way ahead of the NAFTA talks which at this point look like a tense affair given the opening salvo by the United States.

Economic data out on Wednesday was not supportive of the US dollar with the Conference Board’s consumer confidence index fell to 120.3 after a forecast of 123.7. The drop came after a 16 year high last March at 125.6. Confidence still remains strong, but so far retail sales have not reflected the improved assessment from consumers if they don’t spend.

The USD/CAD gained 0.51 percent in the last 24 hours. The currency pair is trading at 1.3588 after the comments from the Trump administration announced a tariff on softwood lumber that could reach 24 percent. Canadian Prime Minister Justin Trudeau reacted by vowing to protect Canadian interests.

The move from Washington had been unexpected as Canada had avoided being in the line of fire of Trump, unlike Mexico and China. The news was specially negative for the CAD ahead of a renegotiation of Nafta. Trump made it one of his campaign promises to tear the deal. He has softened his tone on the trade agreement, looking for a renegotiation now, but echoing back to his inauguration it will be with an America first in mind.

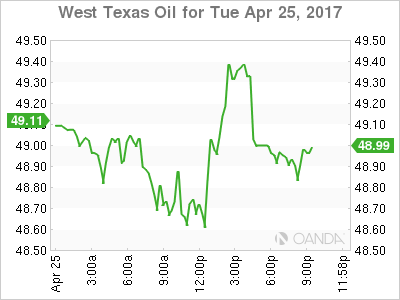

West Texas gained 0.39 percent on Tuesday trading. The price of a barrel of WTI is trading at $49.11 after having traded below $49 earlier in the day. Crude prices have been volatile as investors face uncertainty regarding the effect the Organization of the Petroleum Exporting Countries (OPEC) production cut has accomplished and if a six month extension could offset the ramp in production from US shale producers.

Russia is set to discuss the extension to the deal on May 24, one day ahead of the OPEC general meeting in Vienna. While compliant with the first agreement Russian production is usually slow in the first half of the year so little sacrifices were made. Extending the deal would require sensitive conversations with its largest producers who have already cut 250,000 of barrels of output.

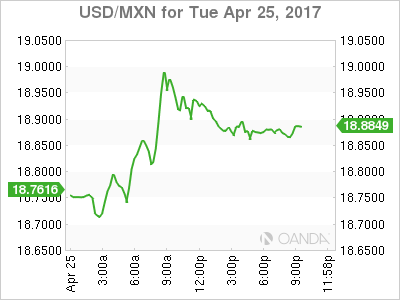

The USD/MXN gained 1.034 percent on Tuesday. The currency is trading 18.9034 after Trump once again tweeted about the Wall along the Mexican border. He wanted to be clear that dropping the funding request from the bill to avoid a government shutdown does not mean he is not still going to pursue it.

The peso also depreciated after the lumber tariffs against Canada were announced as a border tax has been mentioned as a funding mechanism to pay for Trump’s Wall. Nafta currencies were higher after the Macron and Le Pen result in the first round of the French presidential elections with crude adding support by ending a multi-session slide only to face Trump caused market turbulence.

Retail sales in Canada and US crude oil inventories will share the spotlight on Wednesday. The market is expecting a drop in retail sales of 0.2 percent while crude is forecasted to show another 1 million barrel drawdown.

Market events to watch this week:

Wednesday, April 26

8:30am CAD Core Retail Sales m/m

10:30am USD Crude Oil Inventories

11:50pm JPY Monetary Policy Statement

Thursday, April 27

Tentative JPY BOJ Outlook Report

Tentative JPY BOJ Policy Rate

2:30am JPY BOJ Press Conference

7:45am EUR Minimum Bid Rate

8:30am EUR ECB Press Conference

8:30am USD Core Durable Goods Orders m/m

8:30am USD Unemployment Claims

Friday, April 28

4:30am GBP Prelim GDP q/q

8:30am CAD GDP m/m

8:30am USD Advance GDP q/q