The US dollar rose on Tuesday after American inflation data was in line with expectations and consumer confidence came out higher than forecasted. The U.S. Federal Reserve wraps up its two day Federal Open Market Committee (FOMC) meeting on Wednesday at 2:00 pm EDT. The market is not anticipating a major change from the language on the rate statement or the interest rate itself. The September Fed meeting has been priced in for another rate hike as the Fed continues its path toward monetary policy normalization. The private payrolls report from the ADP is expected to show a gain of more than 180,000 jobs and serve as the preamble to the biggest indicator release in the market the U.S. non farm payrolls (NFP) due on Friday.

- ADP forecasted to add 186,000 jobs

- Fed to hold interest rates unchanged

- Central bank week continues with the BoE on Thursday

Dollar Rebounds Ahead of FOMC

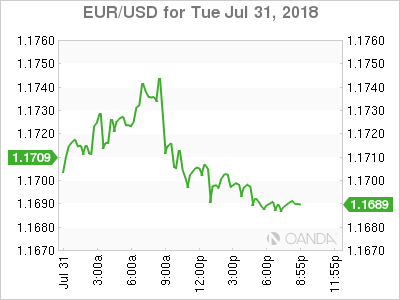

The EUR/USD fell on Tuesday. The single currency is trading at 1.1689 after breaking above the 1.17 price level on positive European indicator releases during the European session. The USD started gaining traction with the release of inflation data and higher consumer confidence numbers but it was the reports that the US and China are trying to meet to discuss trade that boosted the currency. Private conversation are said to be ongoing with a goal of having ministerial meetings that have been on hold since the trade war rhetoric escalated.

The U.S. Federal Reserve is not expected to modify its monetary policy on Wednesday and without a press conference the focus will be on the language changes in the statement. The Fed has already hiked twice in 2018 and policy members have talked about two more interest rates lift if the economy continues on its current growth path. President Trump has already commented that he is not a fan of the Fed’s decision to keep driving interest rates higher. Chair Powell has so far avoided commenting outside of the central bank’s mandate and this week there won’t be a chance for the financial press to seek his opinion on the matter of the Fed’s independence.

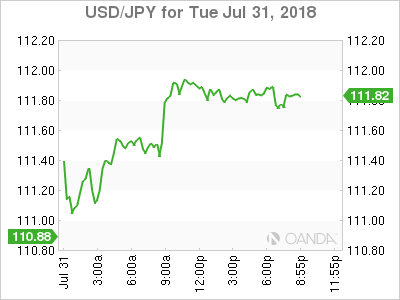

Bank of Japan (BOJ) Underwhelms Sends Yen Lower

The USD/JPY rose on Tuesday after the Bank of Japan (BOJ) kept most of its monetary policy intact, but will allow a wider band on its bond yields as well as the use of forward guidance. BOJ Governor Haruhiko Kuroda said that rates will remain low for an extended period of time. The central bank remains committed to a lofty 2 percent inflation target and has not reached it despite a massive QE program that has been going on for 5 years. Mr Kuroda closed the door to speculation that the BOJ would exit QE.

Investors were underwhelmed by the BOJ’s decision with the currency pair climbing to 111.87 on its way to break the 112 price level. All eyes will be on the U.S. Federal Reserve and its statement on Wednesday. The Fed will follow the BOJ in this busy week with little changes expected, but in current market conditions small tweaks could have big consequences for currencies.

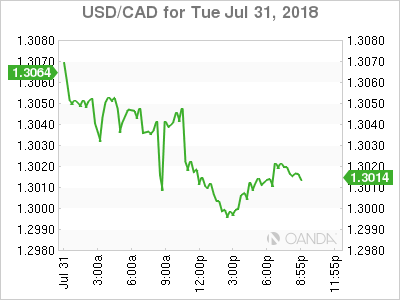

Strong GDP Boosts Canadian Dollar

The Canadian dollar appreciated versus the US on Tuesday after the stronger than expected monthly GDP report. The Canadian economy expanded at a 0.5 percent rate in May versus the anticipated 0.3 percent. The higher annual pace of growth came in at 2.6 percent and has increased the possibility of another rate hike this year, appreciating the loonie versus the greenback on the North American trading session. Oil prices fell below $70 as the US dollar recovered with the announcement of new trade talks between the US and China.

The US dollar staged a comeback after the announcement of lower trade tension between China and the United States. The currency pair touched a session low of 1.3010 at 8:30 am, but is now back at 1.3016 after sources indicated that US Treasury officials and China Vice Premier representatives intend to meet.

The NAFTA and EU-US trade conversations both had positive sound bites this week. Incoming Mexican President was eager for a quick NAFTA renegotiation and he was echoed by the Trump administration. Canada and Mexico made sure to be clear that a trilateral negotiation is needed as the US has been pushing for two bilateral sit downs.

Yesterday US Commerce Secretary Wilbur Ross said that NAFTA talks are close to a deal, specially with Mexico. The latest strategy by the US has been to move faster on talks with its southern neighbour with a new incoming government. Mexico and the US will hold ministerial talks on Thursday in Washington. Canadian officials tried to be part of the meeting but were rejected by the US.

Market events to watch this week:

Wednesday, August1

4:30am GBP Manufacturing PMI

8:15am USD ADP Non-Farm Employment Change

10:00am USD ISM Manufacturing PMI

10:30am USD Crude Oil Inventories

2:00pm USD FOMC Statement

2:00pmUSD Federal Funds Rate

Thursday, August2

4:30am GBP Construction PMI

7:00am GBP BOE Inflation Report

7:00am GBP MPC Official Bank Rate Votes

7:00am GBP Monetary Policy Summary

7:00am GBP Official Bank Rate

7:30am GBP BOE Gov Carney Speaks

Friday, August3

4:30am GBP Services PMI

8:30am USD Average Hourly Earnings m/m

8:30am USD Non-Farm Employment Change

8:30am USD Unemployment Rate

10:00am USD ISM Non-Manufacturing PMI