The Japanese yen is rising against the US dollar after a government report found increased household spending. In July, the household spending in Japan rose by an annualized rate of 0.1%. This was higher than the expected decline of minus 0.8%. It was also the first time the household spending data has been above 0 since March this year.

Spending rose despite average cash earnings climbing by just 1.5%, which was lower than the expected 2.4%. This data measures the change in employment income, including bonuses and overtime pay. On a month-on-month basis, household spending fell by minus 1.1%. This was better than the expected minus 1.2%.

The US dollar is little moved against its top global peers as traders wait for official employment data from the government. Traders expect the non-farm payrolls for August to be 191K. This will be higher than the disappointing 157K released a month ago. The participation rate is expected to increase to 63% while the unemployment rate is expected to drop to 3.8%. Manufacturing payrolls are expected to increase by 24K, which will be lower than last month’s 37K. Average weekly hours are expected to remain at 34.5. The data will come a day after ADP reported Nonfarm Employment change of 163K.

The Canadian dollar fell below an important support after the ADP jobs numbers. During the Asian session, the USD/CAD pair traded below this support level. Today, Statistics Canada will release the employment change numbers. Traders expect that the unemployment rate will increase to 5.9% from last month’s 5.8%. Two hours after the data is released, Ivey will release the PMI data that is expected to drop to 61.4 from last month’s 61.8. These data will be watched closely because they will determine whether the Bank of Canada will increase interest rates as expected in October.

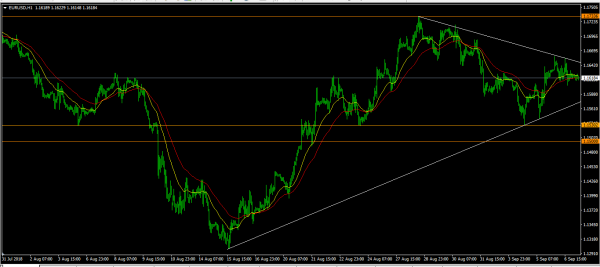

EUR/USD

Over the past few days, the EUR/USD pair has formed a symmetrical triangular pattern as shown on the hourly chart below. It is now trading at 1.1617 as traders wait for the jobs numbers. This level is higher than the 61.8% Fibonacci Retracement and in line with the short-term – 25 EMA – and the longer-term 50 EMA. Positive employment numbers today will make the case for a continued pace of rate hikes and will see the pair fall to the support of 1.1500. Disappointing numbers will take the pair above 1.1700.

USD/CAD

The USD/CAD fell below the support level of 1.3156 yesterday. During the Asian session, the pair remained below this level as traders waited for the US and Canada employment numbers. It is now trading at 1.3130. Positive US employment numbers will likely take the pair back to above the 1.3200 level while positive Canadian employment numbers will take the pair to below the 1.3050 level.

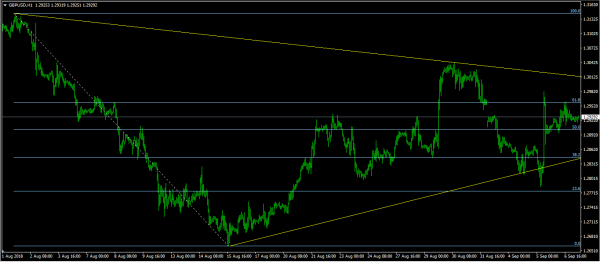

GBP/USD

The GBP/USD pair jumped sharply on Wednesday after the UK and Germany made a deal. It reached a high of 1.2983. Since then, the pair has consolidated slightly below this level and is currently trading at 1.2928. This price is between the 61.8% and 50% Fibonacci Retracement level. With no major data expected from the UK today, the pair will continue trading in range as traders wait for US jobs numbers. Positive jobs numbers will take the pair to the 1.2850 level while disappointing numbers will take it above the 1.3050 level.