Canadian inflation slowed significantly last month as temporary factors that lifted the cost of gas and air travel dissipated.

Canada’s CPI climbed +2.2% y/y, following a +2.8% increase in August and a +3% climb in July.

The market was looking for a solid +2.7% gain in September.

On a month-over-month basis, CPI declined -0.4%.

Digging deeper, the Bank of Canada (BoC) three preferred measures supporting inflation also weakened – core-inflation prices rose in a range from +1.9% to +2.1% for an average of +2.0%, down from the previous month’s +2.1% average.

Despite this morning miss, the headline annual inflation rate in Canada has come in +2%+ for eight consecutive month.

Canada retail sales miss

Canadian retail sales fell unexpectedly in August, led mostly by gas stations receipts declines.

Canada retail sales fell -0.1% in August, m/m, to a seasonally adjusted +C$50.76B. The market was looking for a +0.3% rise.

In volume terms, retail sales declined by a steeper -0.3% in August.

The previous month’s data were revised downward, and indicated receipts rose +0.2% vs. +0.3% estimate.

On a 12-month basis, retail sales rose +3.6% on a nominal basis and +0.7% in volume terms.

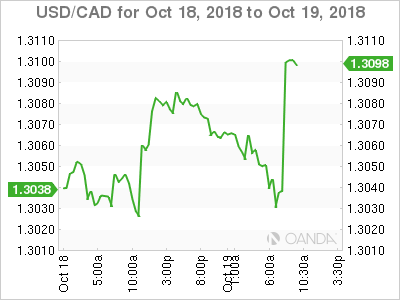

On the release, the CAD came under immense, trading at C$1.3030 before the headlines to C$1.3116.

Next up, the BoC monetary policy announcement is next Wednesday (Oct 24). Despite a weaker retail sales and inflation, the market is currently pricing in another +25 bps hike by Governor Poloz. The OIS mkt still at +97% that they hike.