The loonie was lower against the US dollar despite commodities rising. Moody’s downgraded six major Canadian banks citing high private and household debt that have fuelled a housing bubble. The concerns about a potential crash and its effect on the losses to the financial sector prompted the decision by the ratings agency. Prime Minister Justin Trudeau addressed the downgrades and admitted to the challenges around housing.

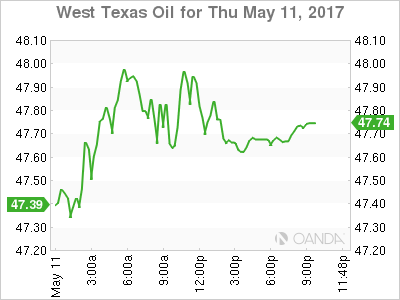

The price of oil rose continuing its gains from yesterday after the fall in weekly US crude inventories but it could offer little support to the Canadian dollar that has been caught amidst rising questions about the overall health of the financial sector after Home Trust Capital saw withdrawals wipe out its long term deposits. Housing speculation has been a known subject that has been discussed by major organizations and the government but with historic low rates it has dominated headlines and household budgets.

Reuters reported that Steve Verheul, the negotiator behind the trade agreement between Canada and Europe will head the NAFTA talks. The Trump administration will go into the negotiations in a position of strength after imposing tariffs on softwood lumber and threatening to abandon the deal altogether took a toll on the loonie.

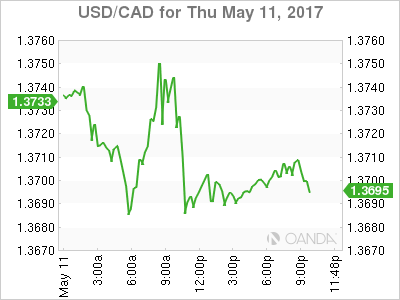

The USD/CAD gained 0.298 percent in the last 24 hours. The currency pair is trading at 1.3694 after the Moody’s downgrade threw a curveball to the CAD. A housing bubble in particular in the two largest cities has been going on for years fuelled by historic low rates. Rising household debt has urged the ratings agency to downgrade the standing of the six major Canadian banks. Delinquency rates are low… but so are interest rates. There are multiple question marks on what will happen when rates go up and people cannot afford to service those mortgages.

The Canadian dollar was down from Wednesday when oil prices spiked following a larger than expected drawdown in the US. The correlation between oil and the loonie is strong, but turbulence in the solid Canadian financial system gave investors cause to break that correlation as they sold the CAD.

There are various calls around the market urging the Bank of Canada to raise interest rates to cool down the overheating housing market but with low inflation, low oil prices and a forecasted slower growth in the second quarter it is questionable the BoC can follow through on that advice.

Oil gained 1.172 percent on Thursday. The price of West Texas is trading at $47.65 following a move that started yesterday with the higher than anticipated drawdown in US inventories. The deal to curb production by the Organization of the Petroleum Exporting Countries (OPEC) and major producers such as Russia stabilized prices since the details were still being hashed out last year. Originally a six month agreement, the group will meet on May 25 to discuss an extension. US producers have benefited from higher prices and have ramped up production minimizing the overall effect of the OPEC deal on prices.

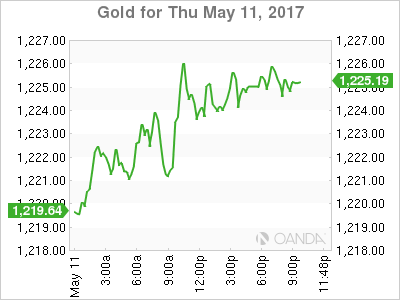

Gold gained 0.545 percent in the last 24 hours. The yellow metal is trading at $1,224.52 after a second day in positive territory. The USD rally that started at the beginning of the week is losing some steam. Fed comments has stoked the USD rally and put downward pressure on the yellow metal, but US political risk after the firing of FBI Director James Comey is keeping the safe haven asset bid.

Market events to watch this week:

Friday, May 12

All day G7 Meetings

8:30am USD CPI m/m

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m

10:00am USD Prelim UoM Consumer Sentiment

Saturday, May 13

All day G7 Meetings