European stocks represent more value but the volatility index is telling us some different story which could make the U.S. stocks more desirable

Today in the markets trading volume is expected to remain reticent, as the biggest market in the world U.S is celebrating Thanksgiving holiday. Yesterday Wall Street have closed mostly positive but NASDAQ is the only U.S. index which is positive to the year to date. Even then there is nothing to be excited about here, as the year to date gains for the NASDAQ index is merely 1%.

As for the other side of the Atlantic, European markets have experienced some reprieve yesterday and traders have decided that it is time to shake off the pessimism. But the year to date performance for the European markets is really awful and it will take some serious commitment by the bulls to push the markets out of their current misery. The DAX index is down nearly over 12% YTD, IBEX has dropped over -10% YTD, Euro Stoxx 50 has plunged over -9.99% YTD and the FTSE has lost nearly -8.29% of it’s value YTD.

There is no doubt that the European markets present a much stronger and better opportunity for investors from a value perspective. But of course, this comes at a cost. There are some serious issues over in Europe; investors are feeling uncomfortable with the European Central Bank winding down it’s quantitative easing program, Italy is not complying with the European Union’s budget requirement and the current tussle is of serious nature. This is due to the face that the Italian government is of strong populist nature. On top of this, we also have the divorce process ongoing between the E.U. and the United Kingdom with no solution in sight

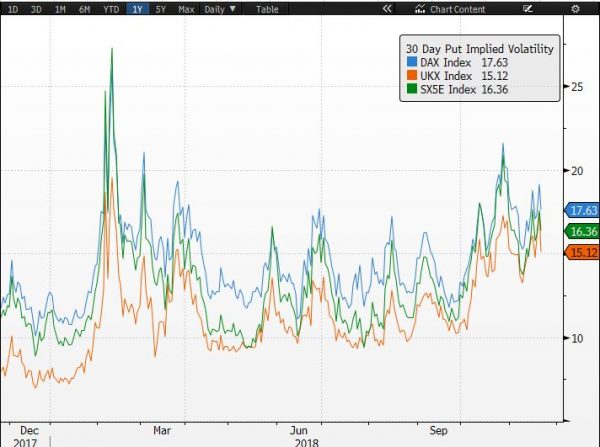

Under these circumstances, volatility is the word that comes to mind and by looking at the market performance for the Q3 one can really see serious spikes in various indices. The 30-day put implied volatility for DAX, the FTSE and Stoxx 50 have one theme in common; all of them are rising since September. This increase in volatility suggests that that the stock market over in Europe may continue it’s over downtrend till the end of this year and this can spill into the Q1 of next year. There is no light at the end of this tunnel yet.

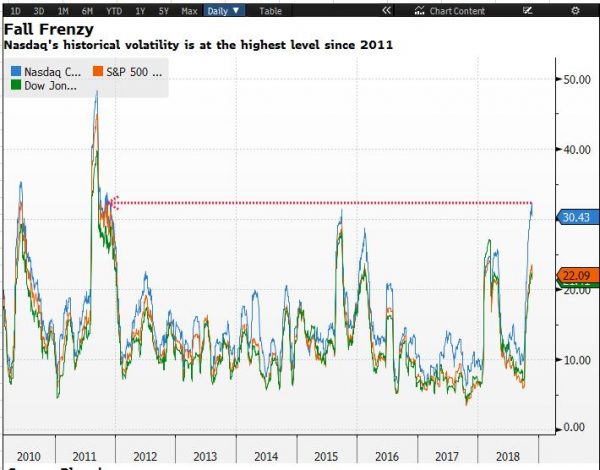

Given the recent sell-off in FANG stocks due to some grave concerns about their future growth, the NASDAQ index’s 30-day volatility has blown out of it’s proportion by touching a level which we have not witnessed since 2011. By comparing apples with apples, 30-day volatility of S&P500, NASDAQ and Dow Jones chart with that of the earlier chart, the key take away is that the US stocks may look stable now but given the recent mammoth spikes in the volatility of three major US indices, the odds are high that we may see some serious sell off for the US stocks in the coming days. This may just remove that attractive element of valued stocks which we discussed earlier because the U.S stocks may become more cheaper.

The SPX volatility index itself is up by 88% so far this year and 143% above from it’s 52-week low of 8.56. The Euro Stoxx 50 volatility index is up only 35% so far this year and 75% up from its 52-week low of 10.4. Comparing the two volatility indices explains that the volatility for the European and the U.S. stocks is increasing and in the coming days we could see some more sell-off.