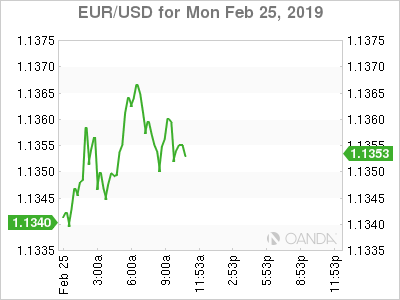

- USD – Risk-on as Trump delays tariff increase

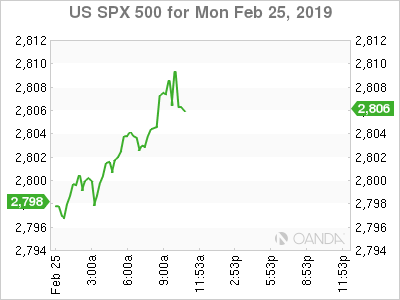

- STOCKS – Rally keeps going

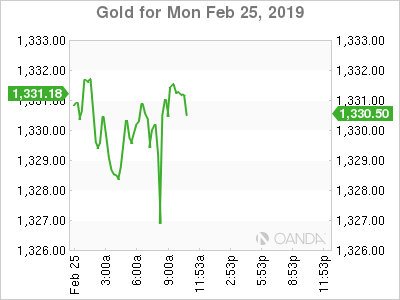

- GOLD – Holding up nicely despite all the positive trade news

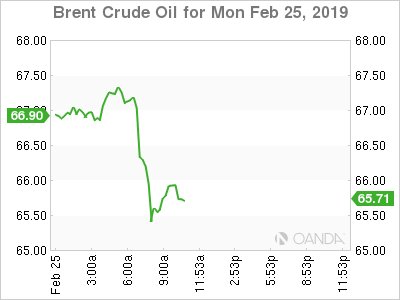

- OIL – Trump perfectly timed his tweet

- Bitcoin – Textbook Short-Covering Mov

USD

Safe-haven currencies are under pressure to start the trading week as key progress has been made in the US- China trade war. President Trump signaled he will delay any potential increase in tariffs on Chinese goods, a removal of the key risk event of the trading week. The trade war is far from over, but continued progress in the right direction continues to support high-beta currencies against both the US dollar and Japanese yen. The Canadian dollar is the lone standout, and heavily under pressure following the move with declining oil prices.

STOCKS

US stock indexes are continuing their V-shaped rally as trade progress was signaled by President Trump over the weekend. The President tweeted, “I will be delaying the U.S. increase in tariffs now scheduled for March 1st.” Financial markets have become overly positive that both China and the US are highly motivated to move forwarded in wrapping up the trade war. Earnings growth forecasts have been halved this year to 5% and while the financial markets have heavily priced in a soft first half of the year, momentum could grow as global slowdown concerns ease as trade war concerns enter a state of calm and accommodative behavior from both the Fed and PBOC keep the party going.

GOLD

Gold prices are holding up fairly well despite a wrath of optimism with progress in the US-China trade war. The precious metal continues to be supported by accommodative stances from the central banks from the advanced economies along with China. The Fed’s pivot in January was tantamount for gold and any further cementing that the next move from the Fed will be a rate cut could help the yellow metal continue to rise.

The Thursday release of fourth quarter GDP could help solidify expectations for the next move to be a rate cut. Current expectations are for GDP to fall from 3.4% to 2.4%.

OIL

Just when financial markets were starting to become immune to President Trump’s comments, he delivered a gem that sent crude prices sharply lower. The President tweeted, “Oil prices getting too high. OPEC, please relax and take it easy. World cannot take a price hike – fragile!”

Before the morning tweet, crude prices were near 3-month highs after Goldman Sachs noted that oil could rise as much as 13%, with Brent possibly rising to the $70-75 range. The research note focus on oil supplies being tight in March and April. The end of year forecast for Brent was maintained at $60 a barrel.

Oil’s recent leg higher stemmed from optimism on trade talks between China and US. With President Trump signaling he will delay the US increase in tariffs, markets are becoming highly positive that deal will be done.

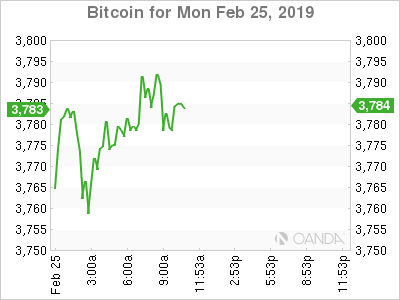

Bitcoin

Bitcoin continues to be hampered on growing regulatory concerns, falling usage, security weakness and rising competition. Over the weekend, the price of one Bitcoin rose above the $4,000 mark, in what appears to be a textbook short-covering move. The cryptocurrency remains vulnerable and could see short-sellers once again return to the market.