Questions are being asked constantly when it comes to Bitcoin’s battle with $4000 mark. The result of this battle makes the sentiment’s bed for a bullish or bearish trend. Since December 14, there have been several battles between bulls and bears at the price level of $4K. In each of this battle, bulls have lost the war because, after the first attack on the $4K, bears have been able to gain enough strength to push the price back below this critical mark. It is in this essence, that this particular level has become a matter of death or life for crypto traders.

This is because if you are a long term investor, you will not really worry about these short term levels. The element of risk premium is of critical importance here and I find this immensely interesting. For a simplicity reason, consider this as a premium that one is willing to pay over the previous low which would have been a better entry price. For instance, the price of Bitcoin at the time of writing this article is trading at 3962 and the recent meaningful low was formed on March 4 when the price touched the price level of $3671. The difference between the two is your risk premium. We all know that it is extremely arduous to catch the extreme low, it is all about making an intelligent choice and buying it when the price is still close enough to its bottom. For investors who are buying at these levels, they usually have a target of previous high, and for Bitcoin, it needs to be the level of 20K.

This is because there is no doubt in mind that the actual next bull run has a minimum potential of pushing the price 5 times higher, that is over $100K. I personally believe that each Bitcoin can go up as much as $400K and if history repeats itself, this number is not a fool paradise. This is a simple math calculation: approximate percentage projection of the price which we experienced during the last bull run.

Why I am saying that crypto winter is coming to end?

Well, before I go and talk about fundamentals, the below chart shows the percentage drop for Bitcoin price after its major rallies. Back in 2011, the price plunged nearly 93 percent and in 2014, it dropped 84 percent. As for the most recent price crash, we have experienced the smallest price crash, 79 percent from its recent high. The most important part is that the price has started to rally back up. This argument becomes even more clear when we look at the bottom panel of this chart. The drawdown percentage curve is much higher now (shown in green circle) as compared to what happened back in 2011 (shown in red circle).

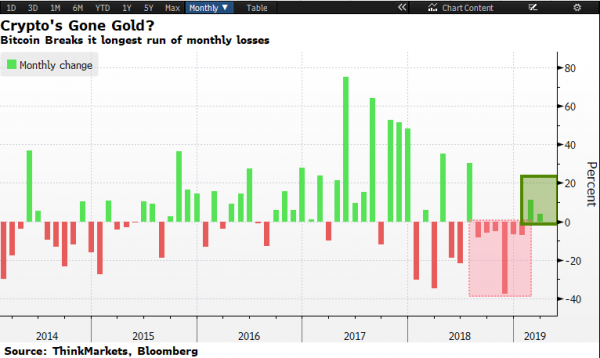

Similarly, if we look at the monthly gains of Bitcoin and plot this on a chart (as I have done this in the chart below), it becomes clear that Bitcoin has broken its longest streak of monthly losses. This is the strongest signal for the bulls that crypto winter is no longer as cold as it was back in December or November.

Another major bull signal comes from the weekly chart as I discussed before, the 200-week moving average (shown in green) has saved the day for the bulls. The 50-week moving average (shown in pink) is moving fast towards the price to close the distance between them. Now, if the price kisses the 50-week moving average goodbye and moves above it at that stage, all bets would be in favor of the bulls. Looking at the chart, when the price breaks above the 50-week moving average, it sends the strongest bull signal and so far it is worked really well. But this is something that we would have to wait and see. It may take a couple of months for this to happen.