It’s all about the wages

The Dollar is opening an on slightly better footing this morning in part due to a big May ADP print ( +253) and more robust ISM manufacturing data, and as traders trim short USD positions ahead of tonight’s Key NFP data. While the market took solace in the solid ADP prints, investors are mindful that this evening’s absolute jobs number will influence USD sentiment much less than the wages component. It’s all about the wages as the AHE will be a key metric the for Fed Watchers.

But wise not to get too complacent on the headline print as the 50K Delta over/under could significantly shift rate hike expectation probabilities beyond June.Given the recent string of middling US economic data, the greater risk would be for a downside miss given the current negative dollar view. Whereas it would likely take a daily double on both the Headline and AHE for the Greenback to convincingly break out of its current funk No question, with the major Trump Tax themes growing dimmer by the day, it’s going to take a substantial jolt of the data to shake this dollar doldrums

The Dow, S&P and Nasdaq all galloped to record highs as equity investors were fired up by the ADP report. After a string of weak to middling economic data this past week, the large print has eased investor angst that the US economy is running out of steam and now appear more upbeat heading into tonight’s NFP

The roller coaster affectionately dubbed ‘Oil Patch’ is heading lower again. After making it’s way up the lift hill on significant US inventories draw we’re back on the dive drop as the old familiar themes come to the fore.The supply glut continues to weigh on near-term sentiment, despite the decline in US inventories, while the prospects of shale output production are rising weights substantially on future prices.

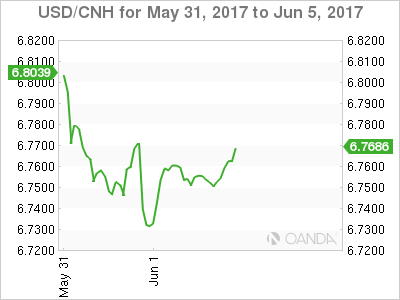

Chinese Yuan

A follow up to yesterday’s major CNH headlines: Finally, a reprieve from the severe Tom Next funding crisis as the three-day carry fell from 300 to 85 in London. And predictably the USDCNH bounced above 6.75 after plummeting to 6.7250 in Asia. While the Pboc has made their views loud and clear, but as the funding crisis abates, I suspect the markets will sheepishly test the water probing every so slightly higher to challenge the Pboc’s resolve.But after getting spanked this week, I believe the aggressive Yuan bears will either go into hibernation or take to the sidelines licking their wounds for the foreseeable future.

Pre CNY fixing: USDCNH trading 6.7570

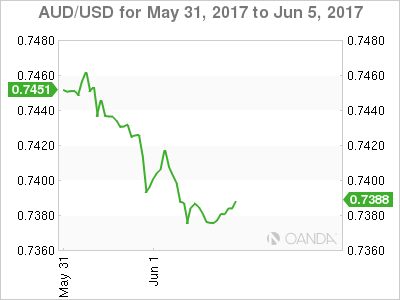

Australian Dollar

AUD is finally caving and was hammered mercilessly thanks to China’s Caixin manufacturing PMI slipping into dreaded contraction zone and plummeting iron ore prices.

The commodity bloc is receiving little support from oil prices which have fallen over a dollar per barrel this morning, and with Iron Ore prices having trouble finding a bid anywhere, we could be setting up for a purposeful move lower for the Aussie

The heaviness in iron ore was difficult to side step as it’s incredibly challenging for the Government to overcome budgetary shortfalls created by these sharp drops. And the outlook doesn’t look any rosier with the tepid China PMI data raising concerns about manufacturing sector demand while the growing stockpiles are a burden to supply.

Despite the growing list of Aussie negatives, we’re likely in a holding pattern for the day after failing to take out .7365 level overnight.The proximity of NFP suggests the next move will be dollar driven, so traders may either opt to sell at better levels post NFP or jump on the waggon if the greenback returns to favour post data. But with high level of USD risk entering the week’s end, dealers preference to express their negative AUD bias is more likely on the crosses with the EURAUD the current market favourite

Next week focus will pivot to domestic concerns as the RBA board meeting, and Q1 GDP will hog the limelight. While no change in interest rates is expected at next week’s RBA meeting, the markets will key on the RBA’s post-meeting statement. But unless the RBA alters their steady as she goes, that too will most likely be a non-event and traders will turn their focus back to external drivers.

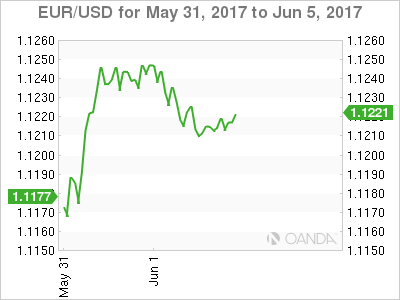

EURO

The monthly end portfolio rebalancing supply of dollars along with some hawkish ECB rhetoric has helped the EURO sentiment into weeks end. And while the current landscape suggests the short-term market is long and want’s to get more extended on dips the increasingly likely Italian elections in September/October has thrown a monkey wrench in the works, and probably tempered some expectation for a near-term shift in ECB policy. But none the less the EURUSD should continue to grind higher based on solid EU economic data alone, and if it can break through the large supply of Euro’s currently on offer through 1.1250-65 region, a break of 1.1300 is all but a done deal.

Hard to make too much of a meal of this morning price action, it’s notably quiet but not untypical of pre NFP trading conditions.