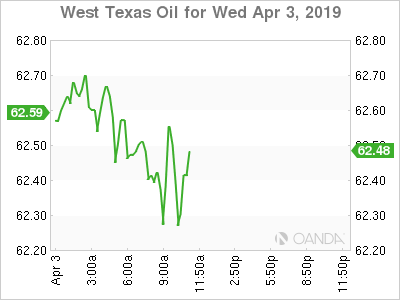

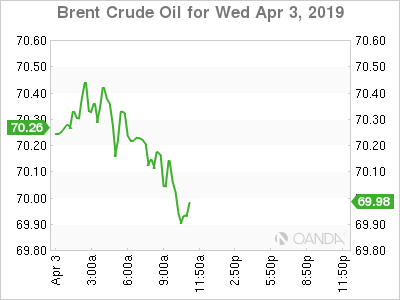

Oil fell on Wednesday after the Energy Information Administration (EIA) reported an unexpected buildup of 7.2 million barrels when the forecast called for a slight drawdown. Crude’s upward momentum was put on pause after the higher supply data point. The API reported yesterday 3 million barrel buildup in US crude stocks and this time it was validated by the EIA with today’s report.

The balance between rising US shale production and the OPEC+ efforts is now tipping in favour of the organization lead by Saudi Arabia. Despite losing the psychological edge by disclosing that its Ghawar oil field is not as large as originally thought, shale production is facing its own problems.

President Trump is not a fan of higher prices and he has used his tweeter influence with limited short term impact. The OPEC+ deal will remain in price until June with a highly anticipated meeting between producers expected to yield another extension.