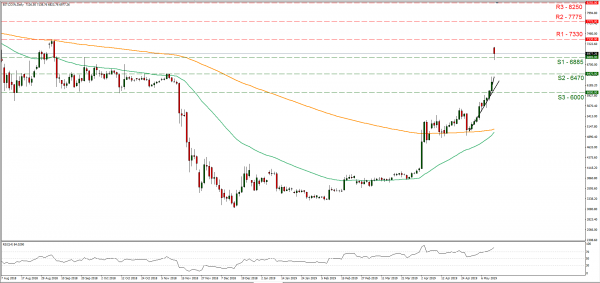

Bitcoin soared during the weekend, breaking the 7000 resistance level briefly and reaching one of the highest levels since last August. Despite there being negative fundamental news lately, with Binance being hacked and New York attorney general claiming there was a fraud of $850m in Bitfinex, the crypto continued its rally over the weekend. Analysts seem to associate Bitcoins rise with the current US-Sino uncertainty, yet we suspect that there may be more to it. Once again, no clear fundamental reasoning seems to rely behind the surge, but crypto investors currently seem to be dominated by the bulls. Bitcoin rallied over the weekend breaking the 6470 (S2) and the 6885 (S1) resistance lines (both turned to support). Despite a number of analysts maintaining a view that the crypto is about to hit a pause button and stabilise as it has reached the August 2018 levels, we suspect that the bulls may be just around the corner once again, should investor sentiment remain bullish. On the flip side please note that the RSI indicator in the daily chart has surpassed the reading of 70, implying a rather overcrowded long position. Should the crypto find fresh buying orders along its path, we could see it rising and breaking above the 7330 (R1) resistance line. Should Bitcoin come under the selling interest of the market, we could see it breaking the 6885 (S1) support line and aim for the 6470 (S2) support level.

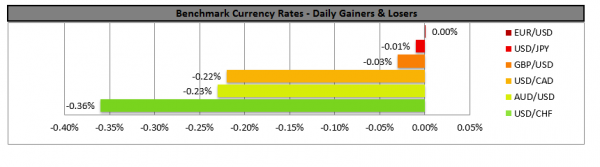

Yen remains firm, while Aussie slips on US-Sino trade war.

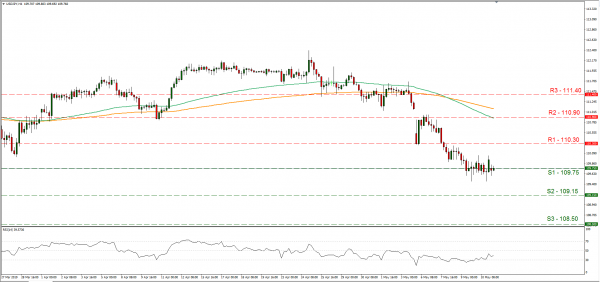

Safe haven JPY remained rather firm against the USD yesterday as the US-Sino trade conflict seems to have no end. The negotiations between the two parties seem to have ended in a deadlock on Friday and it was indicative that analysts pointed out that the only positive point was that the two sides were still talking to each other. Currently the focus point seems to revolve around the US demand for changed in Chinese law and the Chinese refusal to swallow “any bitter fruit”, hurting their interests. In the long run, we expect the two sides to find a solution, yet we also expect a bumpy ride increasing volatility until then. Despite USD/JPY rising on Friday, during today’s Asian session, started the day with a negative gap remaining near the 109.75 (S1) support line. We could see the pair maintaining a sideways movement in the next days, as the market maintains a wait and see position for the Chinese response as well as any further escalation. Should the bears take over we could see the pair breaking the 109.75 (S1) support line aiming for the 109.15 (S2) support barrier. Should the bulls take over, we could see the pair breaking the 110.30 (R1) line.

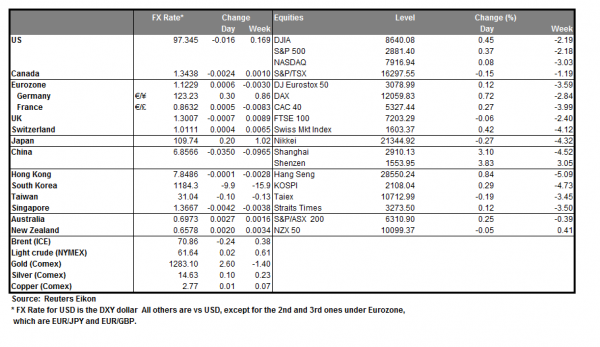

Other economic highlights, today and early tomorrow

In the European morning, we get from Norway’s GDP data for Q1 as well as the Czech CPI rates for April. During tomorrow’s Asian session we get Japan’s current account balance for March.

As for the rest of the week:

On Tuesday, we get from the UK the employment data for March, from Germany the ZEW indicators for May and Eurozone’s industrial output for March. On Wednesday, we get Australia’s Wage pricesfor Q1, China’s industrial output and retail sales for April, Germany’s and Eurozone’s GDP for Q1, the US retail sales for April, Canada’s CPI rates for April and the US industrial output for April. On Thursday, we get Australia’s employment data for April and from the US the Philly Fed Business index for May. On Friday, we get Eurozone’s final CPI rate for April and from the US the preliminary Michigan consumer sentiment for May.

Support: 6885 (S1), 6470 (S2), 6000 (S3)

Resistance: 7330 (R1), 7775 (R2), 8250 (R3)

Support: 109.75 (S1), 109.15 (S2), 108.50 (S3)

Resistance: 110.30 (R1), 110.90 (R2), 111.40 (R3)