For the 24 hours to 23:00 GMT, the USD declined 0.71% against the JPY and closed at 107.30.

Data indicated that Japan’s final machine tool orders plunged 27.3% on an annual basis in May, confirming the preliminary print and declining for the 8th consecutive month. In the preceding month, machine tool orders had recorded a drop of 33.4%.

In the Asian session, at GMT0300, the pair is trading at 107.06, with the USD trading 0.22% lower against the JPY from yesterday’s close.

Overnight data showed that Japan’s national consumer price index (CPI) rose 0.7% on an annual basis in May, in line with market expectations. In the prior month, the CPI had registered a gain of 0.9%. Meanwhile, the nation’s flash manufacturing PMI contracted to a level of 49.5 in June, marking its biggest fall in 2 years and compared to a reading of 49.8 in the prior month.

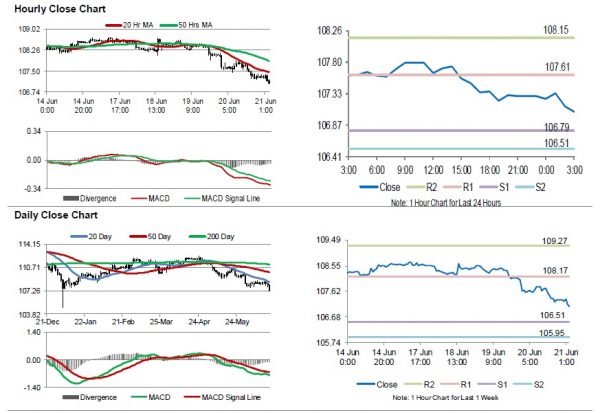

The pair is expected to find support at 106.79, and a fall through could take it to the next support level of 106.51. The pair is expected to find its first resistance at 107.61, and a rise through could take it to the next resistance level of 108.15.

Going forward, traders would await the Bank of Japan’s monetary policy minutes along with Japan’s retail trade, large retailers’ sales, jobless rate and industrial production, all set to release next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.