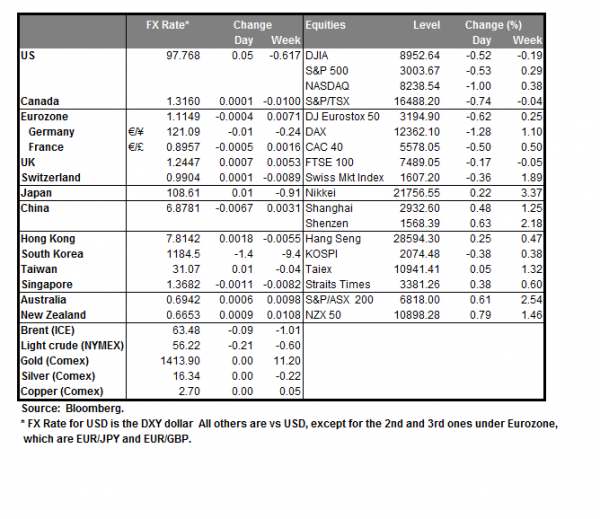

The ECB remained on hold yesterday as was expected keeping rates at 0.00%. However, the ECB president kept it real with the press emphasizing the fact that the situation is getting worse and worse. He referred to the manufacturing sector which is a key sector for the European economy as weakening. Speaking on forecasts he said a rebound was seen in Q2 but now signs confirm weakness and that risks are leaning towards the downside. Regarding a rate cut, he said that they would not comment upon and that they would like to see the next round of projections prior to any decision. Mario Draghi also noted, recession was not the case but if weakness persists, fiscal policy could be needed. Regarding measures that could be taken to improve the economic data, president Draghi said they had assigned Eurosystem Committees to examine options but made reference specifically to compensate banks for even lower rates by offering a multi-tier deposit rate and the possibility of a new bond buying program. The euro initially weakened on the ECB statement but latter ascendant to a high for the day.

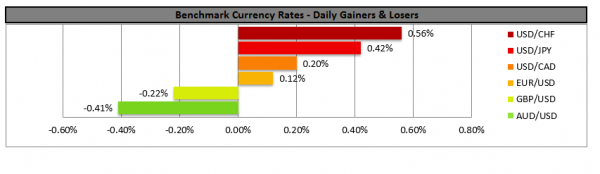

USD strengthens on positive economic data

Yesterday, the US Durable Goods figure was released in the European afternoon. The figure came out at +2.0% much higher than the +0.7%, that was forecasted. The news gave a boost for the greenback as it signals the US economy is expanding. In the previous days, this was also confirmed by the IMF which increased US growth expectations to 2.6% for 2019. Despite the USD moving higher, strong movement was also observed on XAUUSD prices which dropped significantly. Gold prices lost approximately 15 USD upon release of the news. Analysts also site the upcoming meeting in Beijing between US and Chinese officials as positive for the USD. Now, focus is placed on next week’s FOMC interest rate decision were the market could be seeking a rate cut

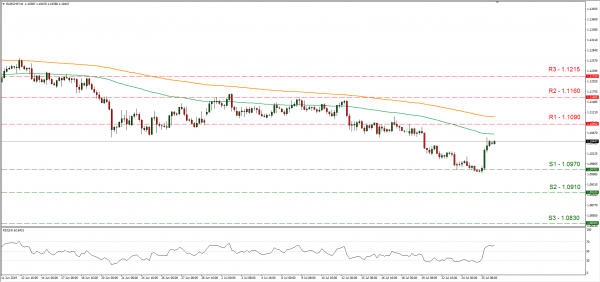

Support: 1.0970 (S1), 1.0910 (S2), 1.0830 (S3)

Resistance: 1.1090 (R1), 1.1160 (R2), 1.1215 (R3)

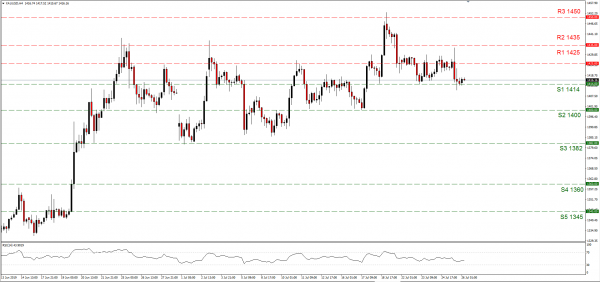

Support: 1414 (S1), 1400 (S2), 1382 (S3)

Resistance: 1425 (R1), 1435 (R2), 1450 (R3)