Key Points:

- Price action appears ready to recommence a move towards the channel bottom.

- RSI Oscillator rising within neutral territory.

- Watch for an upside move by the metal in the week ahead

Precious metals markets have seen some relatively strong swings in the past few months as the market continues to come to terms with the changing battleground which is monetary policy. Subsequently, gold’s directional bias has been a little difficult to predict as it has regularly changed in response to the level of rhetoric emanating from the FOMC. However, some interesting technical and fundamental factors have appeared which could pave the way for a change in the metal’s direction.

Fundamentally, Gold’s price movements have been tightly connected with the Fed’s monetary policy and the past few months have proved relatively negative as the central bank uses the expectation channel to hammer home their desire to raise interest rates. However, the past week has seen much of the speculation of a cycle of tightening start to reverse as the Fed Chair, Janet Yellen, is seemingly backing away from her relatively hawkish rhetoric. In fact, the central banker has been at pains to suggest that she remains ‘Cautiously Optimistic’ whilst at the same time suggesting the Fed is now nearing a neutral interest rate. Subsequently, there is little prospect of successive tightening in the remainder of 2017.

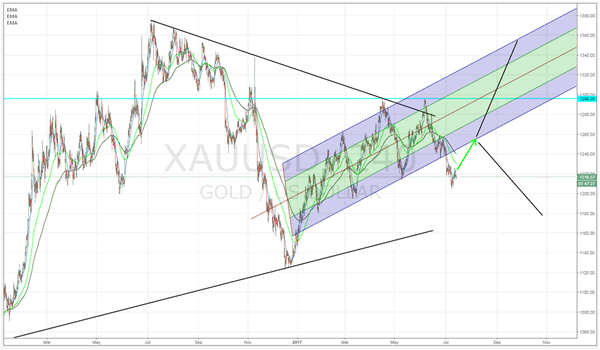

The technical aspects of the precious metal are also suggestive that there is likely to be a change in directional bias in the coming days. In particular, price action has recently fallen out of the bottom of an Andrews pitchfork and was trending lower until the recent spate of Fed dovishness. Since that point, the RSI Oscillator appears to have started trending higher, within neutral territory, whilst price action appears to be consolidating. Subsequently, there is a technical view that, as the sentiment continues to build, that Gold will continue to rise back towards the pitchfork channel.

Subsequently, there are plenty of reasons to see some bullishness for the metal in the week ahead given both the aforementioned fundamental and technical factors. However, at the point where price action returns to the pitchfork, the medium term view becomes significantly hazier with plenty of doubt as to whether the metal will recommence its bullish march towards $1300 an ounce.

Ultimately, the short term is likely to be relatively beneficial to gold prices and the most likely scenario is one where price action trends towards the bottom of the channel at $1239 before further consolidation is seen. At that point, it would be prudent to take a wait and see approach as to whether gold remains upwardly biased