Sentiment edgy as cases leap

Primed for an unabated run higher following a strong overnight session, risk has instead shied away from fresh peaks after sources reported 14,840 new cases of Coronavirus in Hubei. This saw a moderate sell-off across major benchmarks, though in the grander scheme of what moves have transpired in February, it’s still a relatively minor blip.

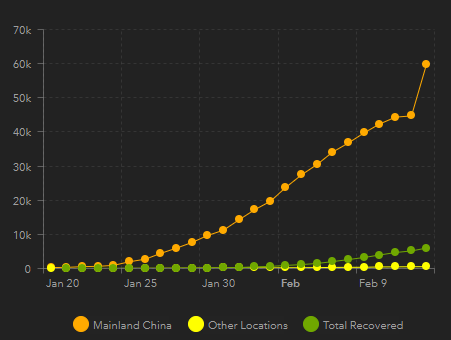

It does bring into focus the idea of under-reporting however. And begs the question how exactly infection levels jumped from some 45k to 60k in one day, and whether markets should be concerned going forward by a more conservative way of reporting. Ultimately, method revisions to a more conservative WHO form indicates markets might be premature in pricing out nCoV risks.

Walking into Europe

While Nasdaq and S&P 500 futures led the charge on the way up, they’ve also lead the charge on the way down after incurring losses of around 0.3%. Softer risk sentiment should spillover into Europe as FTSE and DAX both eye flat starts at the opening bell. Like a broken record, price action has been most sensitive in Asia. This Has seen PSI, SET50, KLSE, SSEC and HSI all finish in the red.

USD safety

FX flows are taking to the news by way of broad USD strength, with AUDUSD and NZDUSD high beta among G10. Though, both did outperform overnight so profit-taking was somewhat expected. Lowe’s address was mainly swept to the side by traders, as headlines from the Australia-Canada Economic Leadership form said “absent the virus, Australia’s outlook was improving”.

USDJPY dropped ~30pips and has since settled under 110. I’m on the lookout for more bearish price action as confirmation that a double-top formation might have potentially formed. For GBPUSD, trading has been relatively flat with volatility quite tight. There hasn’t been any specific catalysts here, rather, the currency continues to move with broader risk sentiment.

Elsewhere, in Asia, familiar scenes percolated EM currencies with KRW, IDR, THB and SGD marginally weaker against the dollar. PHP bucked the trend however, managing to fight its way through to 50.43 gaining 0.2% at time of writing. Conviction was limited though as the situation remains delicate.

EUR carry playing out

EURUSD has broken through Q3 2019 lows but looks to retrace somewhat to test 76.4% Fibonacci levels. It’s an interesting case study seeing the currency’s clear underperformance and lack of interest across the investor community in a risk-on environment. I think investors are taking advantage of EURUSD carry here, with yield differentials/annualised volatility looking extremely good relative to the rest of G10. This encourages more EUR selling and USD buying.

Gold bounces

Gold key levels: $1,563, $1,575. I’ve been seeing some interesting price action from Gold recently whereby there appears to be asymmetry to the downside. That is, risk-on is having less of an impact to the downside, compared to risk-off to the upside. It suggests Gold dynamics could be shifting from a traditional risk-on/risk-off lever.