INDICES

Yesterday, European stocks rebounded. The Stoxx Europe 600 rose 1.61%, Germany’s DAX jumped 2.01%, France’s CAC 40 rose 2.11% and the U.K.’s FTSE 100 was up 1.39%.

EUROPE ADVANCE/DECLINE

81% of STOXX 600 constituents traded higher yesterday.

11% of the shares trade above their 20D MA vs 7% Friday (below the 20D moving average).

45% of the shares trade above their 200D MA vs 43% Friday (below the 20D moving average).

The Euro Stoxx 50 Volatility index eased 0.11pt to 35.23, a new 52w high.

SECTORS vs STOXX 600

3mths relative high: Travel & Leisure

3mths relative low: Insurance

Europe Best 3 sectors

energy, banks, travel & leisure

Europe worst 3 sectors

personal & household goods, health care, retail

INTEREST RATE

The 10yr Bund yield rose 1bp to -0.63% (below its 20D MA). The 2yr-10yr yield spread rose 0bp to -17bps (above its 20D MA).

ECONOMIC DATA

FR 08:45: Sep Budget Balance, exp.: E-165.69B

EC 09:00: Eurogroup Video Conference

GE 11:00: Bundesbank Mauderer speech

GE 17:00: Bundesbank Balz speech

GE 19:00: Bundesbank Mauderer speech

MORNING TRADING

In Asian trading hours, EUR/USD bounced to 1.1650 and GBP/USD edged up to 1.2920. USD/JPY was broadly flat at 104.71. AUD/USD retreated to 0.7038. This morning, the Reserve Bank of Australia cut its benchmark rate to 0.10% from 0.25% as expected and announced a 100 billion Australian dollars bond purchase program of 5 to 10 years government bonds over the next six months. The central bank said it “is not expecting to increase the cash rate for at least three years” and “is prepared to do more if necessary”.

Spot gold eased to $1,892 an ounce.

#UK – IRELAND#

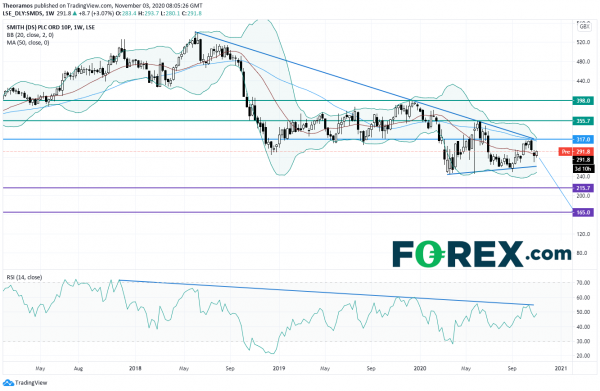

DS Smith, a packaging company, posted a trading update: “Corrugated box volumes in and throughout Q2 have returned to growth versus the comparable prior year period following the challenges of Q1 and we expect volumes for the H1 period overall to be c. 1.5% lower than the prior year H1. (…) While the profit for the half year will be lower than the comparable prior year period due to Covid, we have seen significant improvement in Q2 compared to Q1.”

From a technical point of view, the stock is trading within a symmetrical triangle drawn since March 2020. In addition, the upper boundary of the pattern is a declining trend line in place since June 2018, while the RSI is also capped by a medium-term bearish trend line. Below 317p, targets are set at the bottom of 2014 at 215.7p and 165p in extension.

BP, an oil giant, was upgraded to “equalweight” from “underweight” at Morgan Stanley.

Royal Dutch Shell, a giant oil producer, was upgraded to “overweight” from “equalweight” at Morgan Stanley.

#GERMANY#

Bayer, a pharmaceutical group, announced a 3Q net loss of 2.74 billion euros, compared with a net income of 1.04 billion euros in the prior-year quarter, and adjusted EBITDA dropped 21.4% on year to 1.80 billion euros on revenue of 8.51 billion euros, down 13.5% (-5.1% currency and portfolio adjusted). The company confirmed its full-year revised adjusted EBITDA guidance of 12.1 billion euros and revenue forecast of 43 – 44 billion euros. Meanwhile, the company said it has raised Roundup related cost forecast to 2.00 billion dollars from 1.25 dollars previously.

#FRANCE#

BNP Paribas, a banking group, reported that 3Q net income fell 2.3% on year to 1.89 billion euros, as cost of risk increased 47.0% to 1.25 billion euros, and revenue slipped 0.1% (+2.1% at constant scope and exchange rates) to 10.89 billion euros.

EssilorLuxottica, an eyewear conglomerate, posted 3Q revenue declined 5.2% on year (-1.1% at constant exchange rates) to 4.09 billion euros and 9-month revenue was down 21.2% (-20.0% at constant exchange rates) to 10.32 billion euros.

#BENELUX#

DSM, a science-based company, posted 3Q adjusted net profit (from continuing operations) slid 20% on year to 176 million euros and adjusted EBITDA (from continuing operations) dropped 1% to 383 billion euros on revenue of 1.96 billion euros, down 4%.

#DENMARK#

Pandora, a Danish jewellery retailer, said it swung to a 3Q net profit of 343 million Danish krone from a net loss of 119 million Danish krone in the prior-year period, while revenue was down 8% on year (-5% organic growth) to 4.07 billion Danish krone. The company confirmed its full-year organic revenue growth of -14% to -17%.