- Dollar hits fresh lows, stocks near record highs despite US Senate blocking $2000 checks

- Thin liquidity, or markets calculating what this implies for Georgia runoffs?

- Elsewhere, most assets are in a cheerful mood, but quiet overall

2020 was all about the stimulus game

With the Brexit crusade out of the way, the US stimulus deal wrapped up, and the global vaccine rollout well underway, financial markets are about to end an incredibly chaotic year on a surprisingly optimistic note.

The S&P 500 is higher by 15% in 2020, while the defensive US dollar cannot get off the floor as safe-haven demand has vanished. It’s surreal, but apparently even a lethal pandemic and a vicious recession are no match for ultra-low interest rates coupled with extravagant government spending.

Markets have now entered a quiet phase because of the holiday season, so liquidity is in short supply, making it difficult to decipher whether investors are reacting to new developments or whether the latest moves are simply a reflection of year-end flows.

US Senate blocks $2000 checks, could it backfire electorally?

One such development is that the US Senate blocked an attempt to increase the direct payments to Americans to $2000 yesterday, from $600 in the original relief package. The Republican-controlled chamber later filed its own proposal that would also boost the checks, but with new controversial strings attached, which virtually ensure that the Democrats won’t support it.

While something like this might typically fly under the radar, this time is different, as there is a crucial election in the state of Georgia next week that will determine which party controls the Senate. Outgoing President Trump pulled no punches on twitter when he warned his fellow Republicans that they should approve the $2000 payments immediately unless they have a ‘death wish’.

What’s striking is that even though the Senate blocked the bigger stimulus dosage, the dollar still dived to new multi-year lows in the aftermath while stock markets remained resilient near their record highs. That is the opposite of what usually happens when relief is rejected, which begs the question: is this a reflection of the thin liquidity environment, or does the market think this Republican move could backfire and hand the Senate over to Democrats on a silver platter?

The Democrats have long called for bigger relief packages, so investors may be calculating that either the Republicans will fold under pressure and approve the $2000 checks, or this will help the Democrats emerge victorious in Georgia and ultimately deliver even more. Hence, a win-win situation in the stimulus game.

All quiet and cheerful in the broader market

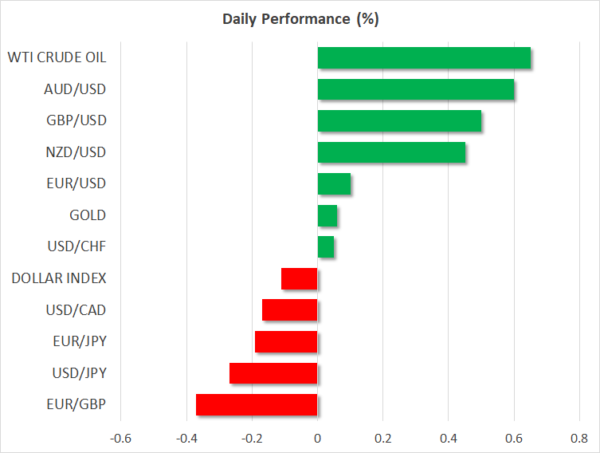

Politics aside, there isn’t much else going on. The mood in the broader market is quite cheerful, with risk-sensitive currencies such as the Australian dollar cruising higher alongside crude oil and most equity indices. That said, all these moves are minor in size.

The British pound is in a good mood too, bolstered by the Oxford-AstraZeneca vaccine being approved for use in the UK, something that could hasten the journey towards vaccinating large swathes of the population. With Brexit out of the spotlight for now, the main variable for sterling may be the vaccine deployment timeline, as that could determine how soon the rolling shutdown game ends and how quickly the economy heals.

Finally, gold is struggling for direction as the year concludes. The yellow metal has been caught in a crossfire between a weaker US dollar and a slight recovery in real Treasury yields lately, leaving it trapped in a narrow range between $1860 – $1905 for now.