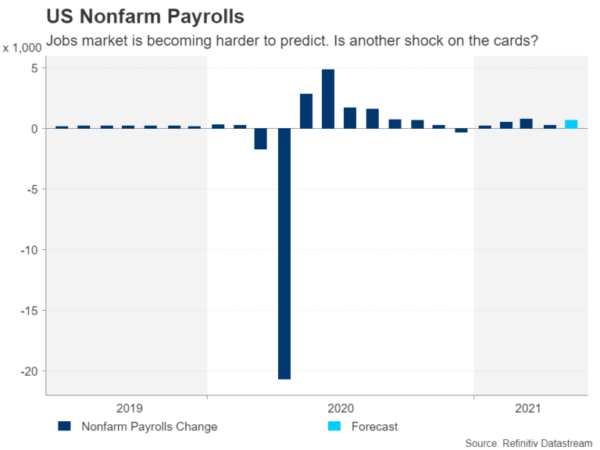

Markets are still reeling from the April jobs report as the massive shortfall from the estimates killed any expectations that the Fed would begin tapering in the summer. The May report is not anticipated to be as much of a game changer even as nonfarm payrolls likely rose by a more eye-watering number. The data, out this Friday at 12:30 GMT, could jolt the US dollar and Treasury yields, but can they bring any clarity to what the Fed intends to do next?

Is NFP getting harder to predict?

The US economy added just 266k jobs in April – a more than respectable figure under normal conditions but a paltry gain during a pandemic when total employment remains more than 8 million below pre-virus crisis levels and when expectations were for a rise of 978k. The estimates for May keep getting revised substantially – the latest Refinitiv forecast is 664k – and this has been the case for the past few months as analysts have been finding it difficult to get an accurate read on the health of the labour market.

The uneven recovery and over-generous government benefits are mostly to blame for infusing increased unpredictability to the NFP data. Businesses that were never shuttered from the pandemic are struggling to find skilled labour while in sectors of the economy that are only just reopening, workers are unwilling to return, either because they are afraid of catching Covid or because the enhanced unemployment benefit they are receiving from the federal government is higher than the wages they would receive from taking up employment.

Ending jobless benefits possibly boosted May payrolls

At least 24 states – all Republican-led – have now discontinued the extra weekly benefit payment so there’s a good chance payrolls in May were boosted as more people were forced to re-enter the workforce. The steady decline in weekly jobless claims throughout May is also indicative of a big jobs bounce. However, other data show unfilled vacancies continued to rise across several sectors in May, suggesting that many Americans are still refusing to work and labour shortages are becoming rife.

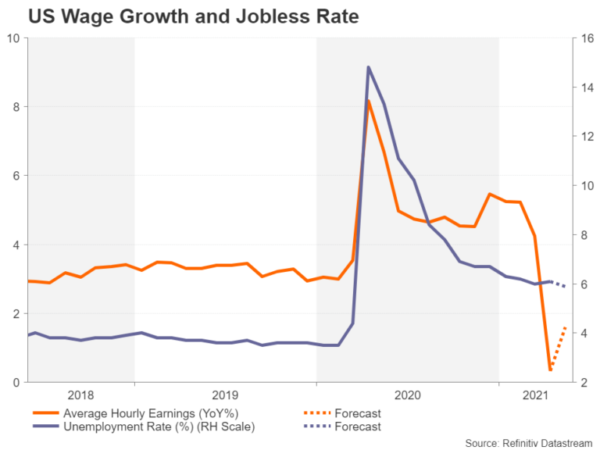

That risks putting upward pressure on wages, adding to the whole range of temporary factors that are pushing up inflation right now. However, wage growth remains fairly muted for the time being. Average earnings are expected to have increased by 0.2% month-on-month to produce an annual rate of 1.6% in May.

Fed might stop at nothing to achieve full employment

The unemployment rate, meanwhile, is forecast to have dropped from 6.1% to 5.9%. Although the fall in the jobless rate from a post-pandemic high of 14.7% to below 6% in such a short period of time may seem impressive, the Fed is probably keeping a closer watch on the labour force participation rate, which has not been recovering as quickly as total employment, implying there’s still plenty of slack in the labour market.

Fed Chair Jerome Powell has repeatedly stressed his determination to achieve full employment and will probably steer his committee to ignore the surge in inflation for as long as possible, or until it becomes apparent that the present price increases are not transitory. However, even if higher inflation does prove to be a short-term thing, the Fed would need to dial back some of its $120 billion a month asset purchases at some point in the not too distant future as the economy comes out of emergency state.

Bracing for another surprise

Hence, discussions about tapering QE could begin as early as the June 15-16 policy meeting. Yet, investors are not freaking out about this prospect and Treasury yields are maintaining their 2-month old sideways range. The April NFP miss eased fears about an overheating economy and other data since then have further underscored the view that this is an uneven recovery. So even if the Fed were to reach a decision soon, investors might now be coming round to the idea that tapering will likely be a slow and gradual process.

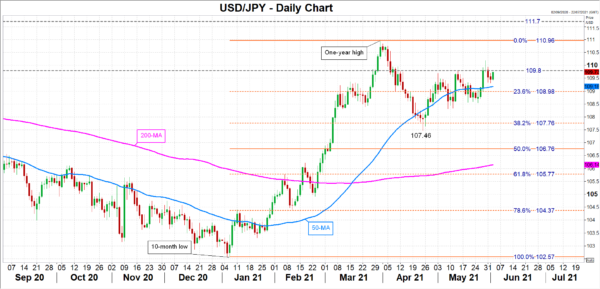

That’s not to say, though, that any further shocks in the jobs numbers won’t be able to rattle the markets. A big positive surprise could give yields a leg up, lifting dollar/yen above the tough resistance region of 109.80. A sustained rally could drive the pair beyond the March 2021 peak of 110.96 and towards the March 2020 highs around 111.70.

If nonfarm payrolls miss expectations again by a wide margin, it would be hard to see dollar/yen holding above its 50-day moving average and sellers could target the April low of 107.46.