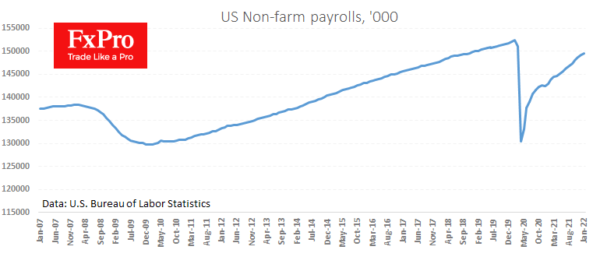

A positive surprise on US employment. The official BLS report showed a jobs increase of 467K, markedly better than the expected 110-165K. Moreover, the previous data was seriously revised upwards and now reports employment growth of 510K in December compared to the initially reported 199K.

Average hourly earnings rose by 0.7% m/m and 5.7% y/y, showing further acceleration and increasing signs that the inflation genie is out of the bottle.

As a result, markets are intensifying their expectations for policy tightening, laying a 34% chance of an immediate 50-point rate hike in March versus 18% before the release.

The strong labour market and the mood for decisive rate hikes also support the dollar, which adds 0.4% after the release. This is likely that the USD growth impulse is far from the end, and dollar growth will continue in the coming days or even weeks.