The global equity market also continues to thaw after a pronounced decline since the start of the year. Initial reports of progress on the peace talks were later supported by indications that the US and China are looking to reduce friction between them and avoid new threats against each other.

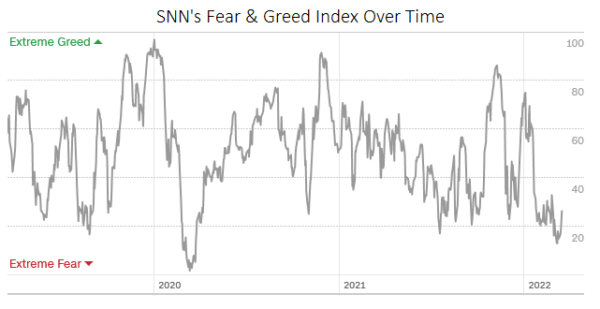

In addition, reassurances from the world’s major central banks over the past week sounded very encouraging. As a result, the Fear and Greed Index has moved out of the extreme fear territory, having bottomed out last week at levels last seen in March 2020. A return to territory above 20 for the index would typically mean a reversal to growth.

One should note the increasing divergence between the S&P500 price and the Relative Strength Index, where since late January, S&P500’s lower lows has been marked by RSI’s higher low.

The S&P500 has bounced back from its lows by almost 6% and is now testing the 50-day moving average. A consolidation above 4400 would signal the start of a broader, more powerful rally. Now it looks like the bravest already bought when there was “blood on the streets”; now, it is time for a broader range of buyers to step in.

Gold and oil prices remain indicators of the military stand-off between Russia and Ukraine. Signs that progress in talks has stalled have put prices of these assets back on an upward trajectory.

Brent crude oil was trading more than 11% above levels at the end of trading on March 16 at the start of the day on Friday. A glance at the chart suggests that technically quotations remain within the uptrend that began back in December. This is in line with the supposed progress in de-escalation between Russia and Ukraine. In our view, it is already worth noting that fears over energy supplies are no longer panic-driven but more constructive, lengthening the forecast horizon.