Summary

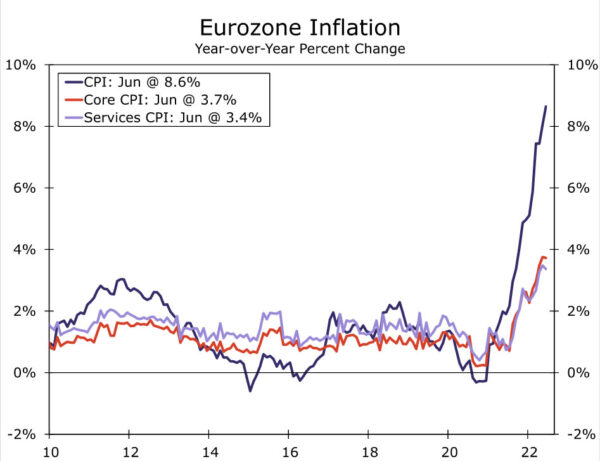

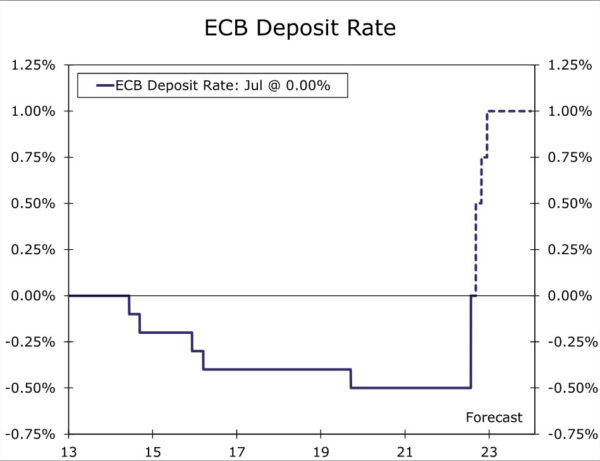

- The European Central Bank (ECB) joined the global rate hike cycle at today’s announcement, delivering a larger-than-expected 50 bps Deposit Rate increase, to 0.00%. The ECB said a further normalization of interest rates would be appropriate at upcoming meetings.

- The ECB also approved the Transmission Protection Instrument (TPI), a tool aimed at supporting orderly conditions across Eurozone government bond markets, in particular the region’s peripheral markets such as Italy and Spain. While full details are yet to be released, the ECB said purchases using the tool are not restricted ex ante, and that the scale of TPI purchases depends on the severity of the risks facing policy transmission.

- We believe inflation remains elevated enough, and inflation risks worrisome enough, to continue with a more forceful pace of rate hikes for the time being. Our view remains that today’s hike will be followed up by another 50 bps Deposit Rate increase at the September meeting. In addition, while inflation remains elevated and until Eurozone economic growth slows in a much more meaningful manner, we also see a steady series of rate increases as more likely than not. In that context, we also forecast a 25 bps rate increase at the October and December meetings, which would bring the Deposit Rate to 1.00% by the end of 2022.

European Central Banks Joins Global Rate Hike Cycle

The European Central Bank (ECB), as widely expected, joined the global rate hike cycle at today’s monetary policy announcement, but in doing so also managed to spring a couple of mild surprises. The ECB delivered a larger than expected 50 bps Deposit Rate increase, thereby exiting its negative interest rate policy and taking the Deposit rate to 0.00%. The other key policy interest rates were also lifted by 50 bps, taking the refinancing rate to 0.50% and the marginal lending rate to 0.75%.

In announcing the larger interest rate increase, the ECB said “further normalization of interest rates will be appropriate. The front-loading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions. The Governing Council’s future policy rate path will continue to be data-dependent and will help to deliver on its 2% inflation target over the medium term.”

Separately and importantly, the ECB also approved the Transmission Protection Instrument (TPI), aimed at supporting orderly conditions across Eurozone government bond markets, in particular the region’s peripheral markets such as Italy and Spain. While full details are yet to be released, the ECB said purchases using the tool are not restricted ex ante, and that the scale of TPI purchases depends on the severity of the risks facing policy transmission. While the announcement of such a tool today was viewed as more likely than not, it was certainly not seen as a “done deal” and, indeed, some reports ahead of today’s meeting hinted at a possible quid-pro-quo among ECB policymakers in that a larger 50 bps increase could shore up support for the anti-fragmentation tool. Whether such a quid-pro-quo was explicitly part of discussions, there certainly appears to be some trade-off between the larger rate increase and the approval of the Transmission Protection Instrument. The ECB said that in addition to an updated assessment of inflation risks, the larger first step towards policy normalization was also reinforced by the support provided by the TPI for the effective transmission of monetary policy.

Of course, after today’s large rate increase the focus now turns to what happens next from the European Central Bank, particularly since they had previously hinted at a 50 bps hike in September. The comments in today’s decision about “front-loading” the exit from negative interest rates and transitioning to a “meeting-by-meeting” approach to interest rate decisions offers hints of at least some potential to shift to smaller 25 bps increments going forward. Indeed, ECB President Lagarde also said prior guidance on the September interest rate move no longer applies. However, as the lead into the July meeting made clear, even forward guidance on interest rates does not guarantee a particular policy rate outcome. Moreover, we believe inflation remains elevated and inflation risks worrisome enough—Lagarde cited inflation risks were to the upside and have intensified in the short-term—to continue with a more forceful pace of rate hikes for the time being.

As a result, our view remains that today’s hike will be followed up by another 50 bps Deposit Rate increase at the September meeting. In addition, while inflation remains elevated and until Eurozone economic growth slows in a much more meaningful manner, we also see a steady series of rate increases as more likely than not. In that context, we also forecast a 25 bps rate increase at the October and December meetings, which would bring the Deposit Rate to 1.00% by the end of 2022. We anticipate that will be the peak during the current cycle—as inflation begins to recede by 2023 and growth slows sharply, we see the ECB keeping interest rates steady through most, if not all, of next year. In essence, after today’s announcement, we anticipate a shorter, sharper rate hike cycle from the European Central Bank than previously.