On Thursday, September 15, XAUUSD lost its major support, which used to limit the downside since April 2020. The decline happened amid expectations of more aggressive Federal Reserve interest rate hikes due to higher-than-expected US inflation.

Why is gold falling?

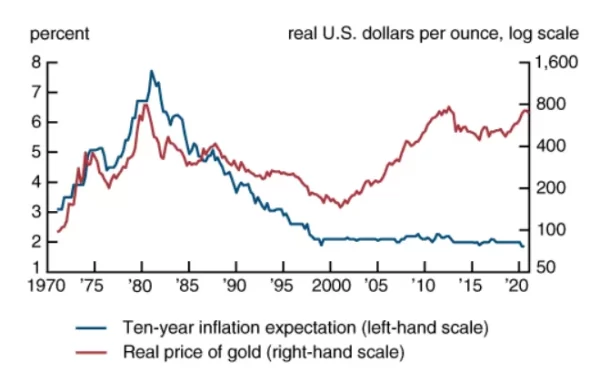

Investors treat gold as a hedge against inflation. A rise in inflation or inflationary expectations increases investors’ interest in purchasing gold and drives up its price. In contrast, disinflation or a drop in inflationary expectations does the opposite.

Gold and inflation expectation. Source: Chicagofed

However, we can notice that since the 2000s, the gold price has been rising while the inflation expectations were steadily low. It was caused by the Fed monetary policy, according to which the Federal Reserve has been printing USDs to support the economy. As a result, the amount of USD in circulation increased parabolically, pushing gold prices to new highs.

USD in circulation. Source: FRED

Moreover, gold is sensitive to expected long-term real interest rates. Since metal is a long-duration durable asset, its price has a strong inverse relationship with the long-term real interest rate. A rise in expected real rates should drive down the price of gold.

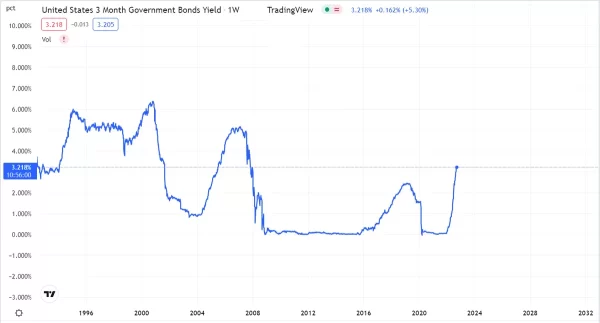

Therefore, central banks’ rate hikes and the Fed’s quantitative tightening (QT) monetary policy make gold one of the most unpopular assets among big investors. Holding the metal doesn’t provide any dividends or payouts, while big hedge funds have to show a profit to investors. Therefore, smart money prefers short-term government bonds to gold, as yields skyrocketed to 15-year highs.

US 3-month Government Bond Yield. Source: Tradingview

What to expect?

While the consensus is a 75-basis-point hike on September 21, some Fed members call for a 100-basis-point increase. The gold market reflects such a prospect. As a result, an actual rate hike by 75 bps may be a positive surprise for the yellow metal.

XAUUSD, weekly chart

After the breakout, primary support levels for XAUUSD are 1530.00, the horizontal level from May 2012, and 1435.00, 161.80 Fibonacci level. The range between 1680 and 1705 acts as the massive resistance for the price since the breakout.

In the short term, the price might increase inside the resistance range to confirm the breakout. However, I expect a massive decline towards the support levels in the middle term.