The first US nonfarm payrolls report for 2023 will be published on Friday at 13:30 GMT, a couple of days after the Federal Reserve announces its rate decision. The event may not cause much volatility for the dollar if today’s policy update adjusts rate expectations beforehand, though it will still be critical in how it can provide extra input regarding whether monetary policy is moving in the right direction.

US labor market loses steam

December’s jobs data beat analysts’ estimate for a smaller addition of 200k, clocking in slightly higher at 223k instead, with the unemployment rate surprisingly inching down to a record low of 3.5%. While the data instantly lent a helping hand to the US dollar, it was not strong enough to alleviate fears that the US economy is heading towards a cliff edge.

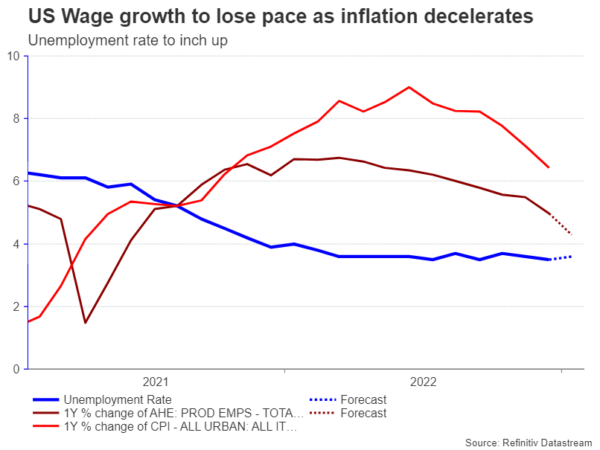

The real picture is that the tight labor market is losing steam and January’s update could provide confirmation of this on Friday. If forecasts are correct, nonfarm payrolls will mark the softest increase of 185k in a year, lifting the unemployment rate slightly higher to 3.6%. Average hourly earnings are forecast to decelerate at a relatively faster pace to 4.3% from 4.6% previously, mirroring slackening economic conditions as well.

Wage concerns far from over

The above earnings stats could be good news for US businesses and a sort of sign that job-matching is becoming more efficient. The figures could also bring some relief to Fed policymakers who are concerned over a potential wage-price spiral.

There is no evidence that wages are fueling inflation so far and if that stays the case, the Fed could follow its plan of softer rate increases. The Employment Cost Index, which is a broad measure of labor costs, posted the smallest advance in a year last quarter. Yet wage concerns are far from over as the increase was relatively firm, and additional solid prints in the first quarter cannot be ruled out given that several companies implement annual changes in salaries at the start of each year.

Rate hike cycle to continue

All in all, it looks like the Fed and other major central banks are currently at a crossroads, and they will need more data before they confidently tweak their forward guidance. Of course, the weakening momentum in inflation and wage growth may allow policymakers to debate whether the tightening phase will pause this spring, though the price stability mandate will remain a top priority. Therefore, the rate hike cycle may continue – probably at a slower pace – even if the economy keeps adding fewer jobs and the unemployment rate starts trending up. Perhaps an economic fallout could help the Fed complete its inflation mission at a lower terminal rate after all.

Analysts believe that wage growth will need to ease to 3.5% y/y in order to press inflation towards the 2.0% target. Hence, the Fed may deliver a smaller 25bps rate hike later today but delay any changes in the statement that says continuous rate increases are likely.

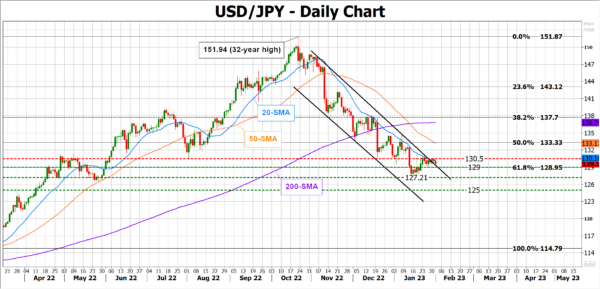

USD/JPY

As regards the US dollar, if the Fed chief sounds more hawkish than expected today, it may pierce through its 20-day simple moving average (SMA) at 130.50 against the Japanese yen and rally towards the 132.50-133.30 resistance zone. A stronger-than-expected NFP report, and particularly an upside surprise in average hourly earnings, may bolster the bullish tone but the impact may be muted if the Fed clarifies the next moves in monetary policy today.

Alternatively, if the Fed appears more conservative, backing investors’ expectations for a pause in spring, and wage data meet forecasts or come below them, dollar/yen could revisit the 127.50-127.20 support region. The 126.50 former constraining zone will also be in focus before the spotlight shifts to 125.00.