With the market remaining on its toes regarding the ongoing banking sector issues, next week brings significant data in the euroland in the form of business surveys and inflation data. The ECB is clearly interested in these economic releases, particularly following last meeting’s change of strategy. However, there is a lingering fear about further negative banking news that could possibly derail the ECB’s tightening effort and put a stop to the euro’s rally.

Central banks would like some quiet time

The universe appears to have moved a few months forward in just three weeks, from the ballooning rate hike projections and the talk about a 6% Fed funds rate in the US to the current subdued rate expectations. Central bankers must have had their world turning upside down over the past weeks, but up to now they have behaved calmly and found some short-term solutions. Whether these would work in the long-term is another story, but central bankers have to remain focused on the economic situation as inflation remains a global issue, while meeting their financial stability responsibilities. A bit of quiet time is a very precious commodity from their standpoint at this juncture.

Following on the path laid down by Lagarde et al last week, Fed chairman Powell announced a rate hike and a possible early end to the current tightening cycle. This abrupt change in the central banks’ strategy is the result of the recent banking sector woes. The collapse of three small US banking institutions and the Credit Suisse saga are expected to significantly impact the overall bank lending and borrowing appetite, potentially rendering further rate hikes unnecessary. The interesting fact from the ECB’s perspective remains that there have not been any euro area bank casualties. If the situation progresses according to the wishes of both the ECB and bank regulators, the market will have a chance next week to refocus on economic releases. At the end of the day, Lagarde laid out the revamped “data dependent” strategy and thus raised the importance of next week’s data.

CPI is the main dish on next week’s menu

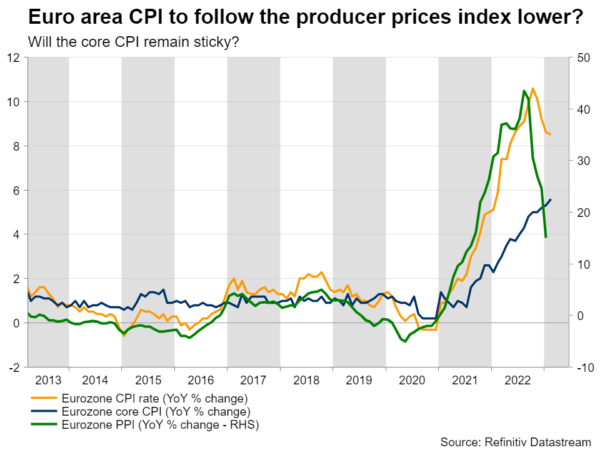

Inflation prints produced the strongest post-announcement volatility during 2022. This appears to have abated somewhat lately, but it is expected to escalate again going forward. On Thursday, we will get a barrage of February CPI prints for the key German states and the preliminary German number, if there are no unforeseen issues like last month. On the following day, the preliminary euro area figure will be released, and the market will be focused on both the trend and the outright level of the inflation figures. The headline number has been on a gentle downward trend, pleasing the ECB, but the same cannot be said for the core component. It has been making higher highs, and a similar print on Friday could result in a plethora of comments from the ECB hawks about the appropriate response at the next rate-setting meeting, especially if it prints above 6% on Friday. On Wednesday morning, the GfK Consumer confidence survey may give us some early hints about the current consumer appetite.

IFO survey on Monday

Next week, though, will start on an equally high note as the German IFO survey will be published on Monday morning. The March edition of the most closely watched leading indicator for the German GDP is unlikely to escape from the March performance of both the ZEW survey and PMIs. It is worth noting that part of the IFO survey responses might have come before the Credit Suisse saga and hence Monday’s results might not be entirely representative of the troubling sentiment on the ground. Having said that, the IFO expectations component is already pointing to a weak first quarter GDP, and another print on Monday towards the 75 area would probably cement these bearish expectations.

Swissie remains under pressure against the euro

Considering the recent economic developments, the market has managed to not get carried away. Stock indices have somewhat recovered from the early March low and euro/dollar remains elevated but far from the early February high of 1.1032. Gold and Bitcoin have clearly been the main beneficiaries of the recent market rout as they continue to keep their gains. This could potentially reveal increased hesitation from investors at this stage.

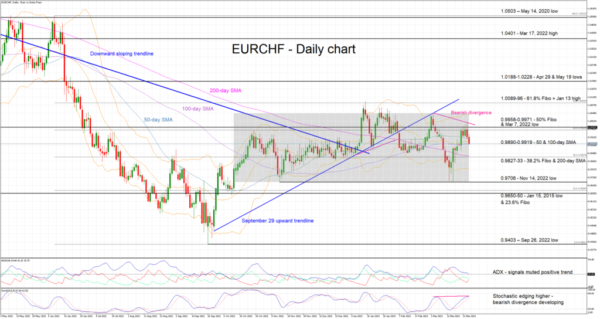

The euro/swissie pair has understandably received increasing attention recently. Since October 13, 2022, this pair has actually been trading inside the 0.9706-1.0041 range. More recently, the Credit Suisse woes allowed the swissie bears to stage a quick recovery towards the busy 0.9960 level. The area extending up to 1.0096 has been a landmine for euro bulls and, at the moment, the overall technical picture is not overly supportive of their intentions. Particularly, the developing bearish divergence between the stochastic oscillator and euro/swissie could derail their plans to aim for a new 2023 high. On the other hand, the appetite by the swissie bulls will be tested at the 50- and 100-day simple moving averages.