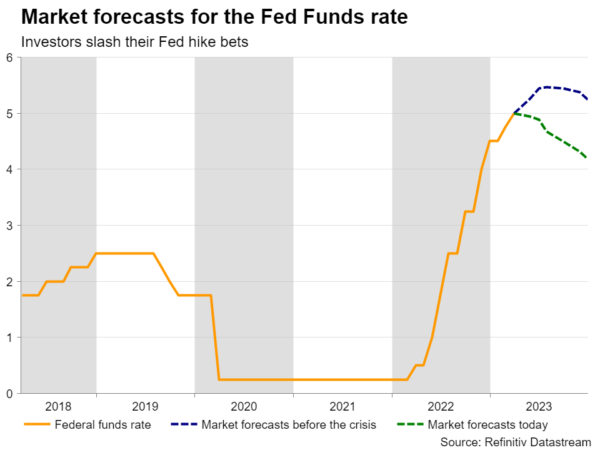

Following last week’s FOMC decision, market participants are assigning a decent chance for the Committee to take the sidelines at its upcoming gathering. More importantly, they anticipate a series of rate reductions for the remainder of the year, despite the new dot plot and Fed Chair Powell indicating otherwise. Now, dollar traders may closely watch upcoming economic numbers, especially the PCE inflation figures due out on Friday as they are the Fed’s favorite inflation gauge.

Fed hints at pause, investors see cuts by year end

Last Wednesday, Fed officials decided to deliver another 25bps hike, but in the statement accompanying the decision, there was a change in forward guidance that was interpreted as hinting that they are on the verge of pausing due to the recent turbulence in the banking sector.

Instead of noting that “ongoing increases in the target range will be appropriate”, they said that “some additional policy firming may be appropriate”. The word ‘may’ was interpreted as opening the door to a pause, and that’s why the dollar fell. Currently, investors are evenly split between taking the sidelines and delivering another quarter-point hike at the upcoming meeting in May, while they are anticipating a series of rate cuts in the next 8 months, seeing interest rates ending the year at around 4.15%.

So, apart from trying to figure out whether another hike is warranted, market participants will also try to better assess the probability of rate reductions. At the press conference following the decision, Fed Chair Powell said that they don’t expect any rate cuts this year, adding that if they have to raise rates further, they will.

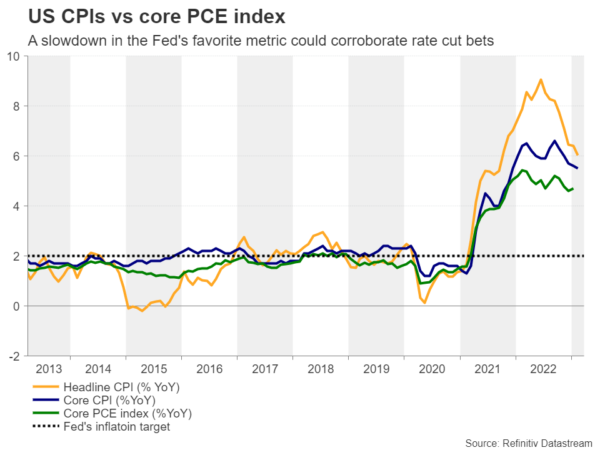

Will the data corroborate the pivot view?

Thus, upcoming data could constitute another piece of information to the rate-path riddle. Traders may pay more attention to the PCE inflation numbers for February, which are considered the Fed’s preferred inflation metric and come alongside the personal income and spending data for the month. Both income and spending are forecast to have slowed notably, but with retail sales sliding during the month, the risks surrounding spending may be tilted to the downside. A potential slowdown in income is corroborated by a slowdown in the monthly average hourly earnings. As for the PCE rates, currently, there is no forecast for the headline, but the core is expected to have held steady at 4.7% y/y.

That said, judging by the slowdown in the core CPI for the month, a similar outcome in this release may not come as a surprise. So, a further slowdown in the core PCE could add more credence to investors’ view that a pause is nearing, thereby weighing again on the US dollar and Treasury yields. At the same time, equities could benefit as expectations of rate cuts later this year mean lower borrowing costs for firms and higher valuations. And with the full effect of the prior hikes not fully transmitted into the real economy, investors could maintain the view that inflation could continue to cool in the coming months.

Other data on the calendar this week include the Conference Board consumer index for March, due out on Tuesday, the pending home sales for February on Wednesday, and on Thursday, the final GDP for Q4.

Fed speakers to enter the spotlight as well

Apart from the data, expectations around the Fed’s future course of action could also be affected by policymakers’ remarks. On Thursday, traders will get to hear from Richmond Fed President Thomas Barkin, while on Friday, after the PCE numbers, New York Fed President John Williams will step onto the rostrum. It will be interesting to see whether they will sing from Powell’s choir sheet and push back against rate cuts bets, but also whether the market will be convinced.

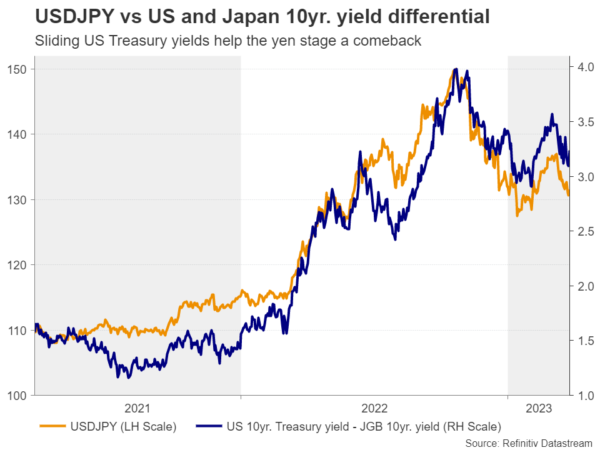

Even the smallest hint that they could consider reductions at some point this year could reinforce the market’s interpretation and magnify the dollar’s losses, especially against the yen, which has been attracting haven flows recently due to the latest banking turmoil. Also, with Japanese companies agreeing with unions to raise wages by the most in about three decades, the chances for the BoJ to remove further accommodation in the coming months may have increased.

Dollar/yen may be poised to continue drifting south

From a technical standpoint, dollar/yen has been in a sliding mode since March 8, when it hit resistance near the 138.15 barrier, which is marked by the peak of December 15. Currently, the pair is hovering near the round number of 130.00, where a clear break could allow the bears to test the low of January 16 at 127.20. A move lower would confirm a lower low on the bigger timeframes and may see scope for declines all the way down to the low of March 30, at 121.25.

For the picture to brighten, the pair may need to climb above the 138.15 area. Should that happen, a higher high will be confirmed and the bulls may feel confident to aim for the peak of November 21 at around 142.25. If they don’t stop there, their march may extend until they meet the 145.65 area, which provided support between October 24 and November 9.