With the yen breaking down lately, Japanese authorities have stepped up their warnings about FX intervention. However, the conditions for intervention are not fully present yet, as the moves in USDJPY in particular have not been sharp enough. For the yen to stage a lasting recovery, it might require some policy tightening from the BoJ or an episode of panic in global markets instead.

Yen meltdown

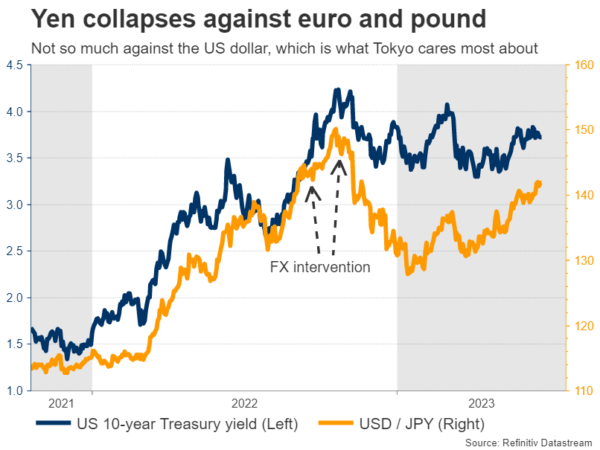

It’s been a dreadful year for the Japanese yen, which has been ravaged by the Bank of Japan’s refusal to tighten monetary policy. With most other major central banks raising interest rates in a hurry, the rate gap has widened, making the yen less attractive to hold compared to other currencies.

Naturally, the yen’s losses have been more devastating against currencies that are backed up by central banks who are expected to continue raising rates. So far this year, the yen has lost almost 14% of its value against the British pound and more than 10% against the euro, plunging to multi-year lows against both.

With the currency in freefall, Japanese officials have returned to their old playbook of threatening to intervene in the FX market. They did it twice last year to stop the yen’s downfall, so their warnings are more credible this time, since investors know they are not afraid to pull the trigger.

Intervention or mere rhetoric?

For now, the risk of FX intervention seems fairly low. Tokyo cares most about how the yen moves against the US dollar, and since that pair has not gone out of control, there isn’t much urgency to step in.

Supporting this notion is the language that Japanese authorities have used until now. The finance minister has refrained from using phrases that would suggest intervention is imminent, such as describing the FX moves as “disorderly” or “excessive”. Instead, he has been more measured with his comments.

The strategy might be to simply threaten intervention in order to discourage speculators from jumping on the bandwagon and amplifying the downside momentum in the yen. In essence, it’s a psychological tactic against speculation.

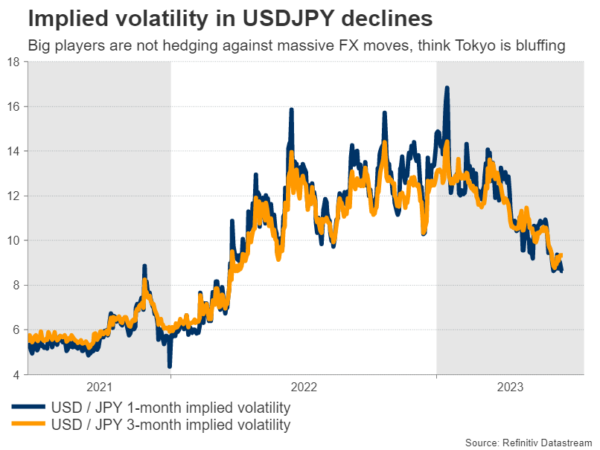

Reflecting the low risk of intervention is the implied volatility in USDJPY, which has fallen dramatically in recent weeks. This suggests that bank dealers and large asset managers are not really hedging against any massive moves in USDJPY, viewing this risk as relatively low.

Some strategists suggest that if USDJPY climbs to 145.00, it would be the ‘line in the sand’ that triggers intervention. But speed matters in this calculation – such a move could prompt intervention if it happens in a week, not over several months. Hence, it’s difficult to say exactly where the intervention ‘line’ is, mainly because it’s a moving target.

Ingredients for recovery

With the likelihood of intervention appearing low for the time being, any sustainable recovery in the yen would need to rely on other factors, such as a policy shift from the Bank of Japan.

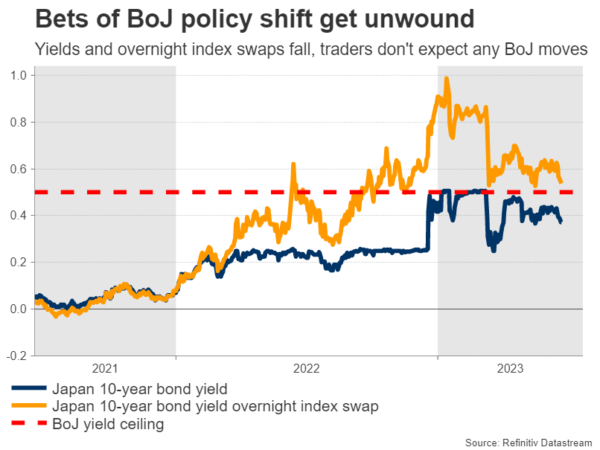

So far, the BoJ has been reluctant to raise the ceiling it has imposed on Japanese yields, even though core inflation is at its hottest level in three decades. Most officials believe this spell won’t last, as the central bank’s forecasts expect inflation to cool later this year.

Haunted by decades of deflation, the BoJ wants to make sure it won’t tighten until inflation is sustainably above its 2% target. That means their forecasts for the next 2-3 years need to show inflation remaining above 2% before they feel comfortable raising the yield ceiling that has ruined the yen.

The plot twist is that this shift could happen as early as next month. If the BoJ upgrades its inflation forecasts for 2025 at the July meeting, which seems likely considering the resilience of the economy, then inflation would be projected to remain above 2% through the entire forecast horizon. This would be a signal that tighter policy is coming, helping to stop the yen’s bleeding.

It’s important to note, however, that market participants are skeptical such a move will occur. Bets that the BoJ will adjust its policy settings have been lowered lately, something visible both in 10-year Japanese yields and in overnight index swaps tracking this instrument. Therefore, any move by the BoJ this year could come as a surprise for investors.

Another variable that will be crucial in enabling a sustainable recovery in the yen will be global risk sentiment. After all, the yen is a defensive currency that tends to shine during periods of panic in global markets. As such, if the euphoria in riskier assets calms down and there’s a correction later this year, that could also help revive the yen through safe-haven flows.

All told, currency intervention seems unlikely at this stage. Instead, the yen’s best chance for a lasting recovery is through the BoJ joining the global tightening race. Traders are saying such a shift is unlikely, yet the economic conditions seem to be falling into place. So while the yen’s crash is not over, it might be entering its final phase.