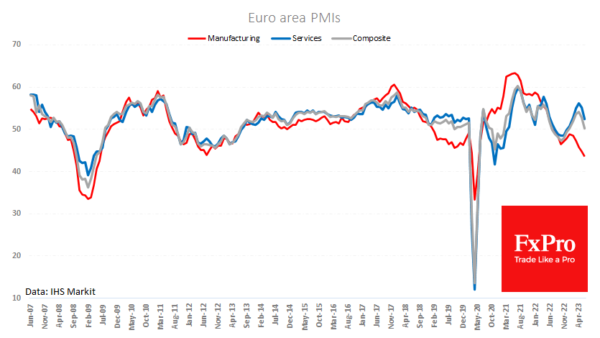

The Euro suffered a setback after the June PMIs revealed a slowdown in economic activity. Analysts were caught off guard by the contraction in French services, which dropped from 52.5 to 48.0 – far below the forecast of 52.2. Manufacturing also disappointed, staying below 50 for the tenth time in twelve months.

Germany followed with a grim report, showing a sharp decline in both manufacturing and services. The manufacturing PMI plunged from 43.2 to 41.0 (43.6 expected), and the services PMI slipped from 57.2 to 54.1 (56.3 expected).

These poor results weighed on the euro zone’s overall performance, where the composite business activity index fell to 50.3, its lowest level since January. The manufacturing PMI came in at 43.6, signalling a severe contraction in the region’s economy soon. Apart from the Covid dip, it has only been lower between October 2008 and May 2009, when the economy shrank by more than 5%. Although the current situation is not as dire, fears are mounting.

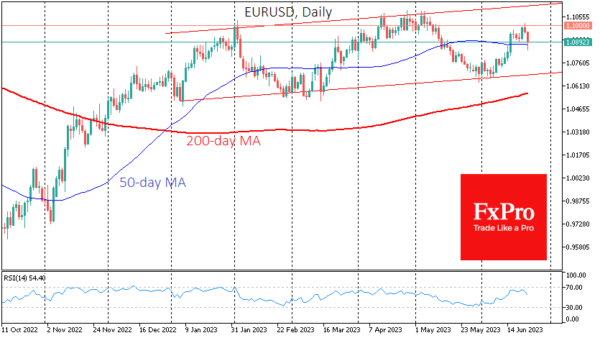

The EURUSD lost around 1.5% in less than a day after touching 1.10 in the middle of the European session on Thursday. It accelerated as it broke below 1.0920 on Friday morning following the release of the Eurozone PMI estimates.

Intraday, the EURUSD is hovering around its 50-day moving average. If it can hold above this level in the coming days, it could attract active buyers and further push the pair to test previous highs above 1.1070. However, weak macroeconomic data and dwindling risk appetite in global markets increase the odds of a downward move, at least to the lower border of the rising channel at 1.0700 or further to the previous local lows at 1.0550.